How much can you save with an offshore accountant?

Sell Your Firm to Samera

Thinking of Selling Your Accountancy Firm?

Collaboration Opportunity to Maximise the Value of your Accountancy Firm on Sale.

The Opportunity

An opportunity to maximise the exit value of your Accountancy firm if you plan to sell within the next 5 years.

The Current UK Accountancy Market

The UK Accountancy Market is facing an existential period.

The rapid advent of AI, constantly changing technology, ESG demands, many firm owners reaching retirement age and a challenging resourcing environment create a cocktail of possible outcomes.

At Samera, we firmly embrace the many changes happening, and believe the next 10 years are a huge opportunity for progressive accountancy firms to create significant value for their owners.

Why Collaborate Now?

Now is an excellent time to build an Accountancy group with like-minded accountancy firms as we can bring together high-quality independent practices.

High quality means a higher valuation upon final exit.

Samera Global is seeking progressive like-minded firm owners planning to exit over the next 5 years.

By bringing together high-quality firms, we will have a strong platform to attract further quality firms and a higher multiple upon final exit for the shareholders.

We believe those firms that collaborate early will benefit the most from an increase in valuation upon final exit.

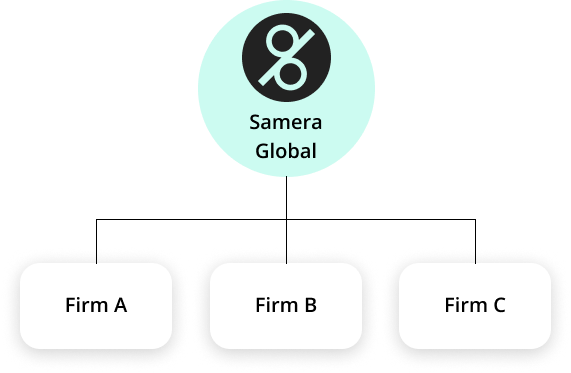

The Aggregator Model

Samera Global will purchase suitable accountancy firms at prevailing market rates.

This will provide a liquidity event for the vendor with a significant cash payment, and with a proportion of the funds received reinvested into the Samera Global Holdco.

The vendors will continue working in their firms.

Samera Global acquires >51% equity stake in each firm, with the firm valued at the prevailing market rate.

The vendor receives a cash sum, with the remainder of the sale proceeds in shares of Samera Global (Holdco).

Each firm will be run by the vendor for a minimum period, to offer new services, and increase EBITDA further through marketing and accountancy offshoring support.

Thinking of selling?

Please click the button below to fill in our form to get started.

EBITDA expansion

With our help of marketing, SEO, accountancy offshoring support, and offering new services, we aim to help vendors increase the EBITDA of their firms further over the 5 years.

Our objective would be to continue acquiring quality EBITDA from further quality accountancy firms, helping each firm grow their EBITDA, so we get to a point where the “Whole is worth significantly more than the sum of the parts”

The Multiple Arbitrage Opportunity

Small, private accountancy firms typically transact at much lower profit multiples compared to their listed counterparts.

This is due to their size and illiquidity.

Through aggregation, a few small firms brought together into one larger company, make the company shares significantly more attractive to a larger pool of investors. The knock-on effect is; an expansion of the company’s access to capital and an improvement in its liquidity.

An increase in liquidity translates into a higher earnings multiple and hence a greater valuation. This is why listed companies trade at a significant premium compared to private companies.

The net result is a larger company that creates value by consolidating smaller companies with a lower earnings multiples into the larger company that has a higher earnings multiple.

This is known as Multiple Arbitrage, where a company uses its valuation to buy businesses at a lower valuation.

Significant Value Creation

For those vendors who reinvest a proportion of their proceeds on sale into the Samera Group Holdco, we anticipate their final exit multiple for the shares they hold to be significantly higher than when they sold their individual firm.

This is the real opportunity to maximise value of the sale of your accountancy firm.

Funding

Our funding will be a mix of debt and equity.

Our Criteria

We are keen to discuss this opportunity with accountancy firms that have the following attributes:

Turnover up to £2m gross recurring fees.

Progressive forward-thinking owners.

Digitally focused firms.

Current owners seeking to stay on for some time to maximise the exit multiple they receive on the final exit.

EBITDA of £100,000+ after paying the owner’s salary.

A desire to grow the accountancy firm further with our help if required.

Seeking a significant cash payment on sale plus shares in the Holdco on sale. It is these Holdco shares that we anticipate will grow in value the most for the early collaborators. The greater the quality of practices and size we acquire the higher the value we will gain on exit.

Thinking of selling?

Please click the button below to fill in our form to get started.

Our Focus on Team Culture

As an accountancy firm ourselves, we fully understand the importance of your team and the team culture you have created over the years.

We feel your people are the most important aspect of your firm, and are keen to talk to practices that focus on the welfare of their teams, and are seeking to make their teams even stronger.

Why Us

We have a wealth of experience in the accountancy sector and a commitment to maximise the value of other firm owners’ hard work with the best valuation on final exit.

We appreciate you have other options available, but if you are looking for an alternative exit strategy with the potential for a much greater return, then please do get in touch.

Thinking of selling?

Please click the button below to fill in our form to get started.

Become a Smarter Accountant

Join "The Unstoppable." our FREE Newsletter for Business Tips for Accountancy Firms.