- Understanding M&A in the Accounting Sector

- Why Accountants Pursue M&A

- Merger vs Acquisition: What’s the Difference?

- Why All This Matters

- Should You Merge or Acquire? How to Decide

- How to Make the Right Choice:

- Pros and Cons of Mergers and acquisitions

- Weighing the Pros and Cons

- Tips to Make It Work

- How to Find Opportunities

- What to Look for in a Good Match

- Financing Mergers and acquisitions

- Executing an Acquisition

- Making a Merger Work

- Final Considerations

- Download the Workbook

Mergers and acquisitions (M&A) has become a key strategy for many practices looking to grow, stay competitive, and plan for the future. Whether it’s mid-sized firms in the UK or large U.S. firms supported by private investors, mergers and acquisitions are changing the shape of the industry. This trend is being pushed by factors like an ageing workforce, shortage of skilled staff, rising tech expectations, and changing demands from clients.

Key Takeaways

- M&A has become a key strategy for accounting firms to grow, stay competitive, and plan for the future.

- Firms pursue M&A for a variety of reasons, including accelerated growth, succession planning, geographical expansion, and talent acquisition.

- A merger is when two firms join as equals to create a new, shared business, while an acquisition is when one firm buys another outright.

- The success of an M&A deal depends on a thorough due diligence process that examines the target firm’s finances, legal standing, HR, and technology.

- To avoid common mistakes, firms should not rush due diligence, overlook cultural fit, or fail to communicate with clients and staff.

- Finding the right firm for a deal involves using a mix of strategies, including working with brokers, networking, and leveraging professional networks and software vendors.

Understanding M&A in the Accounting Sector

Why Accountants Pursue M&A

- Accelerated growth: One of the biggest reasons firms go down the M&A route is to grow quickly. By merging with or buying another practice, they can bring in new clients and increase income almost overnight. In fact, nearly half of mid-sized accountancy firms in the UK have already done a deal in recent years, and even more are planning to do so soon. It shows just how important M&A has become for firms looking to grow fast and stay ahead. [1]

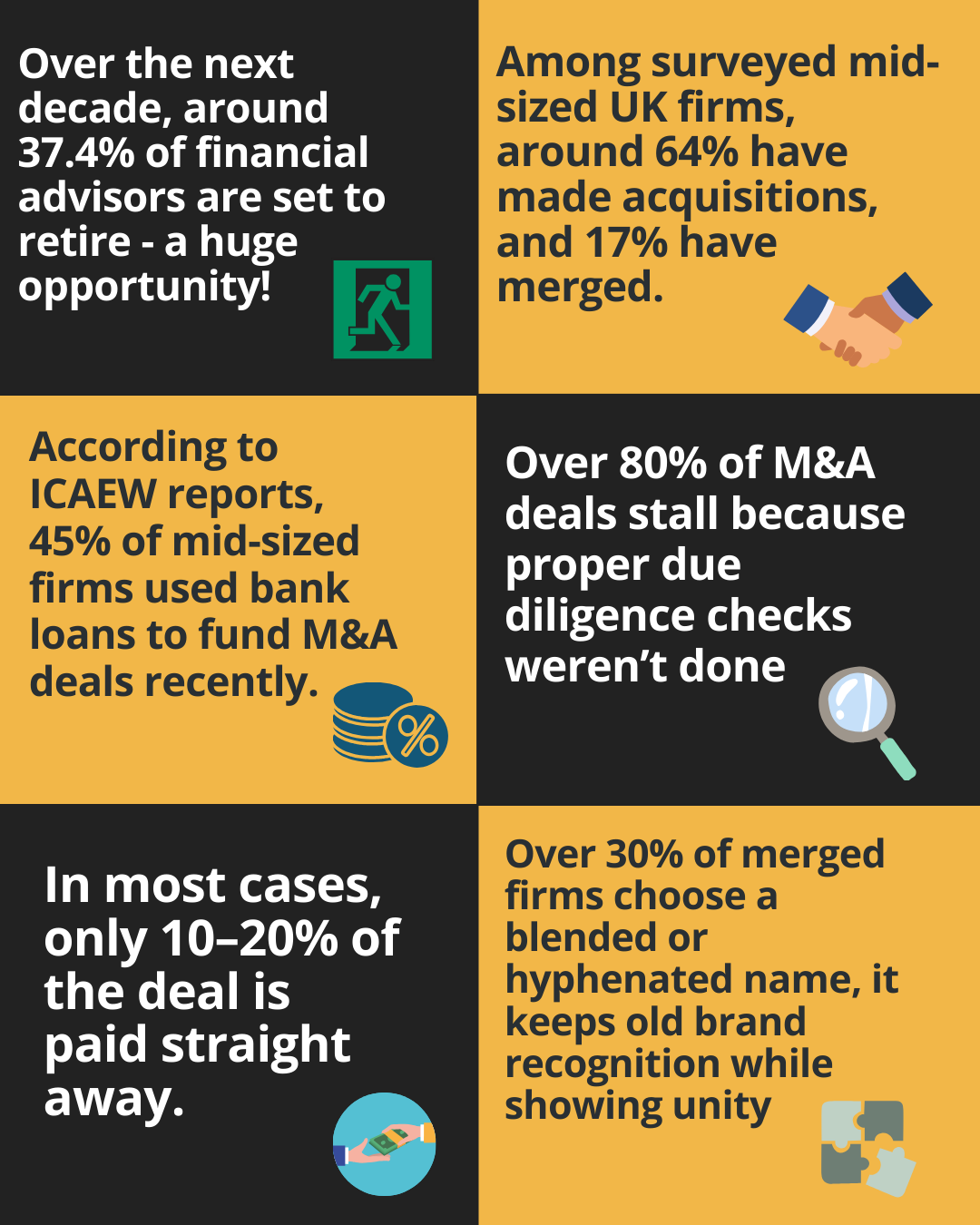

- Succession planning: Many older partners, especially from the baby boomer generation are now thinking about stepping back. Instead of closing shop or passing everything onto the next generation, they’re using mergers and acquisitions to make a smoother exit. A Cerulli Associates report found that over the next decade, around 37.4% of financial advisors (who are often “smaller” practices) are set to retire, and many will use mergers or acquisitions as part of their succession strategy. [4]

- Geographical expansion: Buying a local firm is a quick way to set up shop in a new region without the hassle or cost of starting from scratch. It’s a popular move, especially for larger groups that use the “hub and spoke” model, where one main office supports a network of smaller ones.

- Service expansion: M&A also helps firms widen their service range. It’s a smart way to add specialist areas like corporate finance advice, R&D tax support, cyber security, or digital transformation help without having to build those teams from the ground up. [2]

- Talent acquisition: Finding the right people can be tough, especially when you’re trying to grow fast. Through M&A, firms gain instant access to experienced professionals and future leaders, cutting down on hiring costs and saving time. [3]

- Efficiency gains: Merging also lets firms streamline day-to-day operations. Sharing admin teams, IT systems, marketing, and other support services makes everything more efficient. Plus, it frees up resources to invest in better tech and cyber protection both essential in today’s digital world.

Merger vs Acquisition: What’s the Difference?

Accounting firms often talk about mergers and acquisitions as if they mean the same thing, but there are key differences in how each works, both legally and in practice.

Merger

A merger happens when two firms decide to come together as equals to create a new, shared business. They usually combine their leadership teams, ownership structures, and even their branding.

In the UK, FRS 102 allows “merger accounting” in certain cases, usually when both firms have similar owners and assets are transferred without being revalued. In these cases, a “merger reserve” is created in the books, but it doesn’t show up in the profit and loss account. [5]

Mergers are often seen as partnerships, not takeovers. They suggest fairness and teamwork, where no single firm is in charge of the other.

Acquisition

An acquisition is when one firm buys another, either by purchasing its shares or its assets. The buyer takes full control of other firm’s operations, people, and clients.

In accounting terms, this is called the “purchase method.” The acquiring firm values what it’s bought at market prices and adds things like goodwill or intangible assets to its own balance sheet. [6]

In most cases, the firm that’s been bought is absorbed into the buyer’s business. However, sometimes the sellers stay involved for a while maybe keeping a small share or earning more later if targets are met (this is called an earn-out deal).

Key Differences at a Glance

| Area | Merger | Acquisition |

|---|---|---|

| Legal setup | A new or joint company is formed | One firm buys the other outright through shares or assets |

| Accounting | Uses merger accounting under FRS 102 | Uses purchase accounting, includes goodwill on the balance sheet |

Why All This Matters

There are big differences when it comes to tax, compliance, and reporting. Merger accounting is simpler in some ways but only allowed under strict rules. Acquisitions need proper valuations, thorough checks, and careful handling of any hidden risks.

On the cultural side, mergers are about blending two ways of working. Acquisitions, however, often mean one firm’s culture takes over. That can lead to challenges if not managed well. [7] [8]

Most importantly, how you present the deal makes a real difference to how staff and clients react. A well-handled message can protect trust and loyalty during times of change.

Should You Merge or Acquire? How to Decide

Choosing between a merger and an acquisition is a major decision for any accountancy firm. It’s not just about numbers, it’s about leadership, culture, vision, and the future of your business. The best option depends on what you’re aiming for and how well your firm can handle the change. Here’s a practical guide to help you decide.

Choose a merger if:

- You want shared control. A merger works best when both firms want to join forces as equals, sharing leadership, resources, and brand identity.

- Your cultures match well. For a merger to succeed, both sides need to think and work in similar ways. Without that cultural fit, joint decision-making can quickly fall apart.

- The brand partnership makes sense. If bringing two names together strengthens your market position and reassures clients, a merger can be a smart move.

Choose acquisition if:

- You want full control. With an acquisition, the buying firm takes the lead. It decides how things will run going forward and fully absorbs the other firm.

- You’re taking over from retiring partners. Many acquisitions happen when an older partner wants to exit and hands over their clients and business to another firm.

- You’ve got the resources to handle it. Acquisitions need money, time, and strong internal systems to take on new staff, clients, and ways of working without losing focus.

How to Make the Right Choice:

Financial strength

- Can you afford to buy another firm outright?

- Or would it make more sense to share the load through a merger?

Strategic goals

- Do you want to grow together with another firm over time? (Merger)

- Or are you targeting specific services or locations to expand into? (Acquisition)

Cultural and leadership fit

- Try running joint sessions or planning meetings.

- See how both teams approach decisions, clients, and daily work. If there’s harmony, a merger could work. If not, an acquisition may be smoother.

Key Legal and Operational Points

- You must tell ICAEW (or relevant body) about any merger or acquisition quickly to protect things like your audit rights and compliance certificates. [9]

- The accounting treatment also differs:

- Mergers keep original book values.

- Acquisitions involve revaluation, recognition of goodwill, and more formal purchase recording.

- Communication is vital:

- With mergers, the story is “we’re joining forces.”

- With acquisitions, you’ll need to reassure clients that nothing will change in the service they receive.

Quick Comparison

| Factor | Merger | Acquisition |

|---|---|---|

| Leadership | Shared governance | Full control by the buying firm |

| Cultural fit | Essential | Less important – buyer’s culture often dominates |

| Financial cost | Shared outlay | Larger upfront investment |

| Legal/admin impact | Joint filings, shared risk | Buyer responsible for integration and adjustments |

| Client messaging | “Two firms becoming one” | “You’ll keep getting the same great service” |

Whichever path you pick, don’t skip the groundwork. Do your due diligence, involve your leadership team early, make sure you meet regulatory requirements, and have a clear plan for communicating with clients and staff at every stage.

Pros and Cons of Mergers and acquisitions

Mergers and acquisitions (M&A) can help accountancy firms grow faster than ever but they also come with their fair share of challenges. Here’s a simple breakdown of the good and the not-so-good sides of M&A, along with practical tips to manage the risks. [12]

Pros:

- Quick Growth and Bigger Market Share: M&A gives firms an instant boost in income and client base. Over 70 accountancy-related deals were made in 2024 alone, proof that firms are using this route to grow quickly. Among mid-sized UK firms surveyed, around 64% have made acquisitions, and 17% have merged recently. In fact, nearly a quarter of their fee growth comes directly from M&A activity. [10] [11]

- More Specialist Knowledge and Skills: By joining forces, firms gain access to experts they might not have in-house whether it’s tax, R&D relief, corporate finance, or M&A advice. This is a big win, especially for smaller firms that want to expand their service range without the long wait to train or hire talent. Private equity-backed firms often say this talent boost is one of the top benefits of a deal.

- Lower Costs Through Shared Services: Merging systems like IT, admin, marketing, and compliance can save serious money. Larger firms can negotiate better deals, invest in better tech, and handle more clients without a huge rise in overheads. Plus, with more weight in the market, they often gain stronger pricing power too.

Cons:

- Culture Clashes: One of the top reasons M&A deals don’t work out is when two firm cultures just don’t match. If leadership styles, ways of working, or core values are too different, it can lead to frustration, low morale, and slow progress.

- Losing Clients Due to Poor Communication: If clients aren’t clearly told what’s happening and reassured about how it affects them, they may lose confidence and go elsewhere. Mixed messages or delays in communication can cause damage that’s hard to fix later.

- Integration Takes Time and Money: Merging teams, tech systems, and processes isn’t easy. It demands time, effort, and expertise. You also need to think about things like data protection, PII (Professional Indemnity Insurance) reviews, and IT security, all of which can slow things down and cost more than expected. Private equity firms, for example, often face stricter checks from insurers based on deal size and risk.

Weighing the Pros and Cons

What You Gain | What Could Go Wrong |

|---|---|

| Faster growth, stronger tech, bigger team | Culture mismatch can cause conflict and delays |

| Lower running costs and smarter tech use | Clients may leave if not properly informed |

| Access to talent you don’t currently have | Integration can be costly and time-consuming |

Tips to Make It Work

- Do Your Homework: Look closely at the other firm’s finances, staff, culture, and tech systems before signing anything.

- Plan Integration Early: Start mapping systems, IT platforms, and company culture well before the deal is final. Arrange joint sessions with leadership and key staff.

- Talk to Clients Openly: Let clients know what’s changing and what’s staying the same. Highlight the benefits they’ll receive and be ready to answer questions honestly.

- Sort Out Insurance and Compliance Early On: Don’t underestimate how closely insurers and regulators will review the deal. Make sure all your filings are accurate and submitted on time.

M&A can offer accountancy firms a fast track to more clients, new services, and a stronger position in the market. But it’s not without risk. Cultural misalignment, client loss, and integration struggles are real hurdles. The best results come when firms take the time to plan properly, communicate clearly, and carry out careful checks before and after the deal.

How to Find Opportunities

Finding the right firm to merge with or acquire isn’t just about luck, it takes planning, networking, and a bit of strategy. Successful firms don’t rely on just one method, they explore different channels to find the perfect fit. Here’s how many leading accountancy firms go about it:

Specialist Brokers and M&A Advisors

Professional brokers often approved by bodies like ACCA or ICAEW help match firms, guide deal structures, and handle sensitive talks. With so much interest from private equity in the accountancy world, the market is very active right now. Brokers such as Ashley-Kincaid usually focus on larger practices (those earning over US $1.5 million a year), offering access to deals that aren’t always advertised and helping keep talks confidential. [13] [14] [15]

Professional Networks and Industry Events

Being part of professional groups like the ICAEW Corporate Finance Faculty or platforms like PracticeWeb, Xero, and QuickBooks can open doors. These networks host M&A-focused events, deal boards, and peer meet-ups. ICAEW alone links around 10,000 professionals through its Corporate Finance Faculty, making it a great place to spot opportunities and make trusted connections. [16]

Reaching Out Directly

Sometimes, the best results come from simply contacting firms that fit your goals especially those with retiring partners or similar services. This hands-on approach can lead to better matches, especially if you already know the kind of culture and structure you’re looking for.

Introductions from Suppliers and Software Vendors

Software providers like Xero, QuickBooks, and Karbon now run platforms where firms can find or list acquisition opportunities. For example, Karbon’s marketplace connects buyers and sellers while focusing on tech compatibility, helping ensure both sides use similar systems and workflows, which makes merging smoother. [17]

What to Look for in a Good Match

When reviewing potential firms, keep these factors in mind:

- Client Base: Look for firms that work with similar types of clients, whether SMEs, charities, or family-run businesses.

- Specialist Services: Some firms bring unique services like tax advice, corporate finance, or cloud accounting that could strengthen your own offering.

- Technology: If you both use the same systems (like Xero, QuickBooks, or Karbon), merging operations becomes far easier.

- Firm Size and Culture: Similar team sizes and ways of working often mean less friction during the transition especially important in mergers.

Finding the right firm to buy or merge with takes more than just looking around, it involves using trusted networks, being proactive, and having a clear picture of what you want. Firms that use several routes from industry events and advisors to digital platforms often find better cultural and strategic fits, making the deal smoother and more successful in the long run.

Financing Mergers and acquisitions

Finding the right way to fund a merger or acquisition is crucial to making the deal go smoothly. Luckily, there are several practical options available, depending on the size of the deal and your financial goals. Here’s a breakdown of the most common ways firms are funding M&A deals today.

Self-Funding

If your firm has healthy cash reserves or strong working capital, using your own funds is often the quickest and simplest option.

- No need for external approval or added paperwork.

- Works well for smaller deals, usually under £1 million where the costs can be covered internally.

- Keeps full control within the firm, with no outside ownership or interest payments to manage.

Bank Loans & Debt Financing

Many accountancy-focused banks now offer specialist loans for M&A, such as term loans or asset-based lending. [18]

- According to ICAEW reports, 45% of mid-sized firms used bank loans to fund M&A deals recently.

- Debt allows you to keep full ownership while accessing larger amounts of capital.

- Repayments must be planned carefully to avoid strain on cash flow.

Deferred Payments & Earn-Outs

This option involves paying part of the deal amount later usually over 1 to 3 years based on performance targets like revenue, profit, or client retention. [19]

- In 2023, around 37% of accounting firm deals included an earn-out clause.

- Helps reduce upfront financial pressure and manage risk.

- Keeps the seller engaged and motivated to help the firm succeed after the handover.

Private Equity & Investment Partners

Private equity (PE) firms are showing growing interest in the accountancy sector offering anything from £1 million to over £1 billion in funding. [20]

- Around 12% of mid-tier UK firms have already taken PE backing, and nearly 20% are considering it.

- PE funding supports expansion, succession planning, tech upgrades, and new service lines.

- Firms like Waterland, Hg, Cinven, and IK Partners are active in this space.

- However, deals can be complex, take time, and involve shared control and reporting.

Seller Financing & Retention Escrows

Sometimes, the seller agrees to be paid in stages, often with interest. This is useful when external borrowing isn’t an option.

- Helps smooth out cash flow and ease financial strain.

- Retention escrows where a portion of funds is held back until key staff remain on board, help protect service continuity after the deal.

No matter how you fund it, be sure to understand the risks and plan ahead especially when it comes to staff, clients, and cash flow. The best deals work when both sides feel secure, supported, and aligned for the future.

Executing an Acquisition

Prepare Internally

Getting your firm ready before a merger or acquisition is just as important as the deal itself. Firms that plan ahead and sort out internal matters early tend to complete deals faster and with fewer bumps along the way. Here’s how to prepare from the inside out:

Set Clear Goals From the Start

Before jumping into talks, work out exactly why you’re pursuing an M&A. Are you trying to grow quicker? Bring in new talent? Enter a different market? Or is it part of a succession plan? [21]

Firms that know their goals like replacing retiring partners or adding advisory services have a much better chance of sealing successful deals.

Try using SMART goals (Specific, Measurable, Achievable, Relevant, and Time-bound) to shape your thinking. For example:

- “Acquire two firms in London in the next 18 months”

- “Grow advisory income by 30% within two years”

Bring in Advisers Early

It’s never too early to speak to legal, financial, and tax experts. They’ll help make sure you’re covering all bases:

- Legal advisers help with regulatory checks like anti-money laundering rules, GDPR, and anything to do with audit or international work.

- Financial experts will check how much the business is worth, help with deal structure (e.g. earn-outs), and spot hidden risks such as pensions or off-the-books liabilities.

- Tax specialists can flag issues early and set up the deal in a way that avoids any nasty surprises later.

Plan Post-Merger Integration in Advance

M&A isn’t done when the papers are signed. A lot of the real work starts afterwards, getting teams, systems, and services working as one.

Start mapping your integration plan early. It should cover:

- Shared tech systems – Firms already using the same tools (like Xero, Karbon, or QuickBooks) often see better productivity and fewer hiccups post-merger.

- Staff planning – Think ahead about job roles, leadership responsibilities, and how to keep key people happy and engaged.

- Communication – Have a clear plan for what you’ll say to staff and clients. Focus on consistency, leadership structure, and service continuity to avoid confusion or concern.

Tidy Up Your Own House First

Before approaching anyone, get your own operations in shape: [22]

- Financial records – Make sure your profit & loss statements, balance sheets, and client retention data are up to date and clear. Clean books are vital most firms are valued based on a multiple of recurring fees.

- Technology – Document what systems you use and check compatibility. If you’re switching from one system to another (like QuickBooks to Xero), plan the migration carefully.

- Processes – Have your core processes written down, from onboarding clients to delivering services and doing compliance checks. This shows you’re organised and makes integration easier.

Run Internal Readiness Exercises

Before the deal happens, test how ready your firm really is:

- Hold simulation sessions with senior leaders to rehearse key scenarios like Day 1 handovers, IT integrations, or dual branding.

- Use an internal scorecard to rate your firm’s readiness across key areas, finance, strategy, tech, governance, and culture.

Treating internal preparation as a core part of your M&A strategy not just a last-minute checklist, gives your firm the best chance at a smooth transaction and a stronger future.

Approach the Target

Reaching out to a firm you’d like to merge with or buy isn’t just about making an offer, it’s about building trust from the very first conversation. How you approach this stage can shape the entire deal. Here’s how successful firms handle it with care:

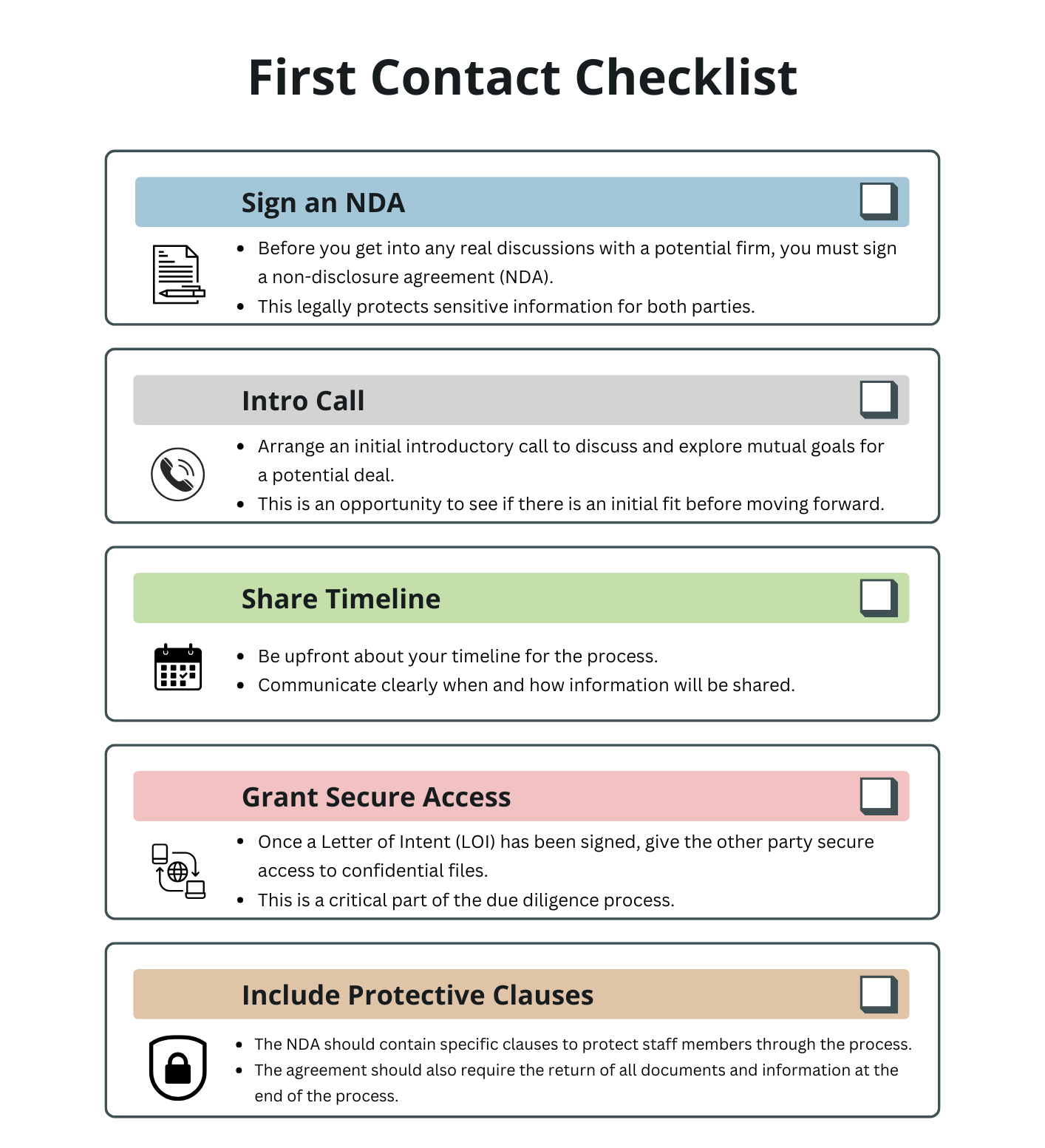

Start with a Proper Confidentiality Agreement

Before any detailed talks, put a confidentiality agreement (also known as an NDA) in place. This protects both sides and shows you’re serious. [23] [24]

- Over 70% of firms say that having a strong NDA is key to protecting sensitive info during talks.

- The agreement should clearly state what’s being shared like financial records, client lists, or business plans and who’s allowed to see it.

- Most NDAs last between 2 and 5 years and include clauses about returning or destroying documents when talks end.

Lead with Shared Goals, Not Numbers

Your first conversation shouldn’t be about profit or client lists. Start with the bigger picture, what are you trying to achieve, and how could working together make sense?

Talk about things like:

- Growth plans

- Services offered

- Company culture

- Tech systems used

Firms that focus on shared values and long-term goals in the early stages are more likely to close successful deals than those who lead with numbers.

Build Trust First – Share Details Later

It’s tempting to dive into the numbers straight away but it’s better to share sensitive information step by step. This gives time to build trust while keeping your firm protected. [25]

- Only share full financials after signing a Letter of Intent (LOI).

- Give access to documents gradually and only through a secure system.

- Add extra layers of protection with non-solicitation clauses (so staff aren’t poached) and clean teams (if needed).

The first approach isn’t about deals, it’s about relationships. When you lead with professionalism, protect both sides, and focus on shared values, you set the stage for a smoother deal, stronger trust, and faster progress down the line.

Due Diligence

Due diligence is the backbone of any successful merger or acquisition. When firms skip over the details or rush this part, deals often fall apart. In fact, industry data shows that over 80% of M&A deals stall because proper checks weren’t done. On the flip side, buyers who take their time and do thorough groundwork tend to avoid nasty surprises and usually get better value. [26]

Financial Checks

Start by looking at the past 3 to 5 years of financial records things like profit & loss statements, balance sheets, cash flow reports, debts, unpaid invoices, and reserves.

- Calculating normalised EBITDA (earnings before interest, tax, etc.) and working capital.

- Understanding how the business is valued many deals fall between 4 to 6 times EBITDA.

- Watching out for red flags like:

- Too much income from one or two clients (over 50% from one source is risky)

- Aggressive accounting habits

- Hidden liabilities, such as legal claims or tax issues

Legal & Compliance Checks

Look closely at:

- Contracts with clients and suppliers

- Lease agreements

- Loans and any outstanding repayments

- Lawsuits or insurance claims

Also, don’t forget:

- VAT and tax filings (e.g. PAYE, HMRC audits, or any U.S. tax reviews if relevant)

- Regulatory checks – especially GDPR, anti-money laundering laws, and rules set by ICAEW or ACCA (such as audit partner independence)

Staff & HR Reviews

People are often the most valuable part of an accountancy firm, so take a good look at:

- Employment contracts, roles, pay structures, bonuses, and benefits

- How long staff have been with the firm and how likely they are to stay

- Any restrictions (like non-compete clauses)

- Whether you’ll need to offer retention bonuses or escrow arrangements to keep key staff after the deal

It’s also a good idea to get a feel for the company culture early on. If the working styles or values don’t match, things can get rocky post-deal.

Technology, Systems & Cybersecurity

Make sure you know what tech the firm uses this includes accounting software (like Xero or QuickBooks), practice management tools (Karbon, CRM), client portals, and backups.

Check:

- Whether systems are secure and up to date

- How data is backed up

- If there’s a plan in place in case of a cyberattack

Doing this early makes it easier to merge your systems later.

Common Mistakes to Avoid

- Rushing the process – It may seem tempting, but it often leads to missing serious risks

- Overlooking IT or cybersecurity – These are now crucial in most deals

- Skipping culture and HR checks – If the team doesn’t gel, it won’t work

- Ignoring tax or legal documents – These can lead to last-minute surprises or even deal cancellations

A structured approach to due diligence, split into two clear stages helps uncover any issues early, confirm the true value of the firm, and prevent problems after the deal is done. When done right, the entire process usually takes around 2 to 4 months and sets the stage for a smooth and successful transition.

Deal Structuring and Valuation

Getting the valuation right and choosing the right deal structure can make or break a merger or acquisition. Whether you’re buying or selling an accountancy practice, here’s a straightforward guide to help you navigate this key part of the process.

How to Value a Firm

1. GRF Multiples (Gross Recurring Fees) [29] [30]

This is one of the most common ways to value small-to-mid-sized practices.

- Most firms are valued at around 1× GRF (sometimes between 0.9× and 1.3×).

- Deals with large earn-outs might go for a lower multiple, as more risk sits with the seller.

2. EBITDA Multiples (Earnings Before Interest, Tax, etc.) [31]

Larger firms with stronger cash flow are often valued this way.

- A business with £1M–£10M in EBITDA might sell for 3× to 11× EBITDA.

- A recent example: a firm with £3M in revenue sold at nearly 4× EBITDA.

3. SDE or Revenue Multiples (for smaller firms) [32]

Smaller, owner-managed practices are often valued on Seller’s Discretionary Earnings (SDE) or straight revenue multiples.

- SDE multiples usually range between 1.8× and 3.3×, and revenue multiples from 0.7× to 1.1×.

Types of Deals

Share Purchase Agreement (SPA)

- The buyer takes over the company as it is, clients, staff, and contracts all stay in place.

- Clean and simple, especially for keeping continuity.

Asset Purchase Agreement (APA)

- The buyer picks and chooses which assets and liabilities to take on.

- Helpful for leaving behind unwanted parts of the business and can also be more tax-friendly in some cases.

Payment Options

- In most cases, only 10–20% of the deal is paid straight away.

- Some deals are all-cash, but that’s less common.

Deferred Payments / Instalments [35] [36]

- Payments are often spread over 5 to 7 years, especially in larger deals or where funding is involved.

Earn-Outs

- Part of the payment depends on future performance (e.g., hitting targets for revenue, profit, or client retention).

- Around a third of deals include earn-outs to balance risk between buyer and seller.

In Summary

- GRF valuations usually sit close to 1×, while EBITDA multiples can vary a lot depending on firm size and margins.

- Pick a deal structure (SPA or APA) that matches your needs, and tailor payment terms to balance cash flow and risk.

- The more your firm is growing, systemised, and future-ready, the more attractive it will be and the better your outcome.

Negotiation

Negotiating a merger or acquisition isn’t just about numbers it’s about understanding people, building trust, and getting the details right. Whether you’re buying or selling, the way you handle negotiations can make all the difference. Here’s a step-by-step guide to doing it properly:

Know Why the Seller Wants Out

Before you even talk numbers, find out what’s driving the seller. Are they retiring? Burnt out? Looking for a better cultural fit or financial reward? [37] [38]

Each of these motivations will affect how they approach the deal.

- A seller planning to retire may care most about a clean exit.

- Someone staying on might prioritise job security or brand legacy.

Ask thoughtful, open-ended questions early on:

“What’s your ideal outcome after the sale?”

“What do you want to avoid?”

“What would a successful deal look like for you?”

Understanding their reasons can help you shape an offer they’ll want to accept and avoid deal breakers later on.

Align Expectations Before Discussing the Details

Start by talking big-picture:

- Will the team stay on?

- What happens to the brand?

- Will there be earn-outs or long-term incentives?

- Who will run the firm after the deal?

Set these expectations before diving into the numbers. It creates a foundation of trust and gives you both room to shape the deal creatively.

It also helps to keep emotions in check. Deals can get tense especially when one side feels uncertain or undervalued. A neutral advisor or broker can help steer the conversation and keep things constructive.

Formalise with Heads of Terms and Legal Contracts

Once you’ve agreed on the main points, put them in writing through a Heads of Terms (HoT). This document outlines: [39]

- Agreed price or valuation

- Staff or leadership arrangements

- Earn-out conditions (if any)

- Any exclusivity period

- Governance or decision-making structures

The HoT isn’t legally binding, but it sets a clear direction and avoids confusion later on.

After that, you’ll need to draft a Sale and Purchase Agreement (SPA) or Asset Purchase Agreement (APA) – this is the legal contract that finalises everything. It should cover:

- Warranties and indemnities (protections for both parties)

- Payment timelines

- Staff obligations

- Escrow terms (e.g. withheld funds to ensure promises are kept)

- Any special conditions before closing the deal

Private equity deals often come with longer agreements (sometimes 50+ pages), especially if the seller is staying on in some role.

Quick Checklist for M&A Negotiation

| Step | What to Do |

|---|---|

| 1 | Understand the seller’s reasons for selling |

| 2 | Set clear expectations – about staff, strategy, and culture |

| 3 | Involve professionals – advisors or brokers can add huge value |

| 4 | Draft a Heads of Terms to get things on paper early |

| 5 | Finalise the SPA or APA with legal guidance |

| 6 | Double-check legal, operational, and tax alignment before signing |

How to Execute a Successful Acquisition

A successful acquisition depends on how well you bring everything together: clients, staff, systems, and performance. Here’s a practical guide to help you get it right:

Client handover

Client relationships are the heart of any accounting firm so communication is key.

Start with joint announcements: co-signed emails or letters, welcome messages on your website, or even short online events can help clients feel reassured and informed.

Next, arrange personal introductions: when possible, have both the old and new firm leaders meet with top clients. A warm handover builds trust and shows continuity.

Why it matters: Most client loss happens because of confusion or silence. Clear, joint communication avoids that.

Staff onboarding

People make the firm work so they need clarity and support.

- Define roles early: Let new team members know where they fit, who they report to, and what’s expected of them. This avoids uncertainty and shows leadership.

- Host cultural meet-ups: Whether it’s workshops, group lunches, or team-building sessions, bring the two teams together early to build familiarity. Cultural clashes are one of the top reasons mergers fall apart, so don’t skip this step.

Tip: Firms that focus on culture early on often see higher morale, quicker team bonding, and less staff turnover.

Tech/process

Merging two firms often means merging different tools, too.

- Plan data migration carefully: Whether you’re moving from Xero to QuickBooks or vice versa, clean up your data first. Run test transfers and double-check the results to avoid surprises.

- Train the team: Offer clear guidance, hands-on support, and quick-access help guides. Use automated tools where you can, like Dataswitcher or SaasAnt, to speed up the transition.

- Standardise your way of working: Agree on shared processes for things like invoicing, task reviews, and client onboarding. One way of working makes life easier for everyone.

Why it matters: Smooth tech integration avoids downtime, errors, and frustration and helps the team settle into their new rhythm faster.

Track progress

Track the right metrics to see how well the integration is going.

Some useful ones to monitor:

- Client retention rate – aim to keep at least 90%

- Team morale and engagement – via pulse surveys or informal check-ins

- Revenue growth and cross-selling – are you expanding existing client services?

- Tech adoption – is the team using the new systems properly?

Review progress monthly for at least the first year. Keep checking in, adjusting, and offering support where needed.

Acquisition Integration Checklist

| Phase | What to Focus On |

|---|---|

| Before the deal | Plan messaging and choose tech systems |

| First 30 days | Introduce clients, assign staff roles, begin tech setup |

| Months 1–3 | Run cultural sessions, unify workflows, start measuring KPIs |

| Months 3–6 | Check system use, address staff/client concerns, refine processes |

| Months 6–12 | Hold review meetings, plan next steps for growth and cross-selling |

Handled thoughtfully, an acquisition can do more than grow your firm, it can make it stronger, smarter, and more resilient.

Making a Merger Work

How a Merger Works

Mergers in the accounting world don’t succeed just because contracts are signed. The real success comes from how well the two firms combine leadership, ownership, branding, and client care. Here’s how well-prepared firms get it right:

Who’s in Charge?

Leadership must be shared clearly and fairly. Around 45% of mid-sized accounting mergers use joint leadership setups like co-managing partners or a shared steering committee to balance control and keep things running smoothly. [40]

- Divide responsibilities early: One partner might handle operations, another finance, and another client services.

- Agree on decision-making: Set a system for resolving deadlocks, this avoids future delays and disagreements.

- Refresh your governance: Put a strong leadership structure in place right after the deal, with clear roles and accountability.

Who Owns What?

Ownership shares should reflect what each firm brings to the table, clients, staff, systems, or capital.

- A 50:50 split is common for equal partnerships.

- But 60:40 (or similar) might work better if one firm is larger or more established.

Make sure all partner rights, exit options, and vesting timelines are properly written into legal agreements. This avoids arguments later and helps everyone plan their future.

What Name Will You Trade Under?

Branding matters more than many expect. Over 30% of merged firms choose a blended or hyphenated name, it keeps old brand recognition while showing unity. [41]

Before making branding decisions:

- Check your digital presence: Your firm’s name affects search engine rankings and client recognition.

- Review client feedback and marketing stats: Make sure the change won’t confuse or affect your visibility.

- Set a budget: Even small rebrands cost money, but if done well, they boost visibility and signal a fresh start.

How Will Clients React?

Clients need reassurance that their service won’t suffer. Early, clear communication is key.

- Send joint letters or emails from both firms, explaining what’s changing (and what’s not).

- Meet your clients in person or over video to maintain trust and show continuity.

- Keep changes gradual: Don’t rush into new fees or procedures. Wait until the merger is bedded in and communicate changes clearly.

Merger Action Plan

| Stage | What to Do |

|---|---|

| At announcement | Share leadership plans, ownership structure, and support details |

| First 30 days | Launch joint branding, meet key clients, and start team-building sessions |

| Months 1–6 | Review client feedback, assess leadership effectiveness, and tweak branding or operations if needed |

Mergers aren’t just business decisions, they’re about people, trust, and identity. When firms put time into transparent leadership, fair ownership terms, a smart branding plan, and thoughtful client communication, the result isn’t just a bigger firm, it’s a stronger one.

Cultural and Team Integration

A merger or acquisition works best when both sides blend their cultures into one united, motivated team. Firms that focus on communication, values, and team-building from the start tend to keep more staff, boost morale, and get better long-term results.

Find Common Ground in Values and Work Style

Before trying to bring teams together, it helps to understand how each one works. What do they value most – client service, innovation, precision, teamwork?

Use simple tools like staff surveys, open discussions, or culture-mapping exercises to spot where you’re similar and where you’re not. It could be how decisions are made, how flexible working is, or how client service is delivered.

By highlighting shared values early on, you avoid misunderstandings later and build a stronger foundation for working together. [42]

Build Mixed Teams from Both Sides

Don’t keep the two firms separate after the deal. Instead, create joint teams for things like HR, branding, tech, or client service. Let staff from both sides co-lead projects so they get used to working together as equals.

This mix helps people learn from each other and builds trust. Firms that do this often see quicker integration and fewer people leaving after the merger. [43]

Communicate often and consistently.

Regular communication is key. Don’t just send one email at the start and hope everyone gets on board.

Plan regular updates through team meetings, newsletters, or casual check-ins. Let people know what’s changing, what’s staying the same, and how they fit into the bigger picture.

Create space for staff to ask questions and share worries. The more open and honest the conversation, the smoother the transition. [44] [45]

Learn and Train Together

Bring everyone together for shared training not just on new software or systems, but on how the new firm will work.

Run workshops on values, processes, and tools. Whether it’s learning how to use QuickBooks or aligning client service styles, learning side-by-side creates a sense of team spirit.

Firms that hold a few of these sessions in the first few months see better cooperation and stronger relationships across teams.

Blending two firms successfully takes more than good spreadsheets and contracts, it takes empathy, teamwork, and shared purpose. When you bring people together the right way, you don’t just merge businesses you build a stronger one.

Operational Integration

Turning a merger into a smooth-running operation takes more than just signing paperwork.

It’s about syncing systems, aligning teams, and keeping everything running like clockwork. When done well, operational integration turns two firms into one stronger, more efficient business.

Bring Everyone onto the Same Software

Using different systems in one firm can cause delays, errors, and confusion. That’s why many merged firms move to a single platform like Xero, QuickBooks, Karbon, BrightManager, or CCH iFirm.

Moving everything over might sound daunting, but most modern tools now have built-in migration support. For example, QuickBooks and Xero offer fast and easy transfers, sometimes completed within a day or two. Once on the same system, teams work faster and with fewer mistakes. [46]

Create Standard Processes & Templates

Using the same engagement letters, pricing structures, and service terms across the board helps keep things fair, clear, and compliant.

Most practice management tools let you automate these processes from client onboarding and billing to document checks. That means less admin work and more time for staff to focus on client service and advice. [47]

Set Up a Central Admin and Compliance Team

Instead of having separate admin teams running different ways, build one strong support team for the whole firm. This group can manage key tasks like risk checks, deadlines, billing, and reporting.

Tools like CCH iFirm help pull everything together into one dashboard giving partners a clear view of what’s happening, who’s doing what, and where the risks are. [48]

Put Someone in Charge of the Change

Integration doesn’t happen by itself. Appoint a project lead or integration manager who can stay on top of timelines, support the team, and fix issues before they cause problems.

This person (or team) makes sure everyone’s pulling in the same direction, deadlines are met, and people have the help they need to get used to new tools and processes.

Keep an Eye on the Numbers

It’s important to check if things are working. Track things like:

- How quickly staff are using the new systems

- Whether billing is happening on time

- How often mistakes happen

- Staff satisfaction and feedback

Many software platforms now come with live dashboards that help you monitor all this in real time and make adjustments as needed.

Merging two firms isn’t just about growth, it’s about doing it the right way. By uniting systems, streamlining how you work, and supporting your team through the change, you turn a complex merger into a strong and stable foundation for the future.

Final Considerations

Legal and Regulatory Compliance

Getting the legal side right after a merger or acquisition isn’t just a box to tick it’s essential to protect your firm’s reputation, your people, your clients, and your future.

Here’s a clear and practical guide to making sure everything stays compliant after the deal is done.

Inform Your Regulator Early

If your firm is regulated by ICAEW, ACCA, or a similar professional body, you’ll need to let them know about the merger or change in structure ideally before it’s completed.

Most regulated firms send updated registration forms within 10 working days after the deal to keep their audit status and licences in place. ICAEW, for instance, can take up to 12 weeks to process changes, so the earlier you start, the smoother the process. [49]

Follow TUPE Rules When Moving Staff

When teams move across to the new firm, TUPE (Transfer of Undertakings Protection of Employment) regulations apply. These rules protect employees’ existing terms and conditions.

Make sure all affected staff are properly informed and understand how their roles, rights, and benefits will continue after the transition. TUPE also supports legal data sharing between the firms, helping you stay GDPR compliant. [50]

Manage Data Transfers the Right Way

Any personal or client data being transferred as part of the deal needs careful handling under GDPR.

Use secure virtual data rooms (VDRs) rather than copying or downloading large chunks of data. Only move what’s essential, and make sure everyone affected – clients, staff, suppliers is kept in the loop.

Getting this wrong could lead to heavy fines and reputational damage, not to mention legal responsibility falling on the acquiring firm.

The Information Commissioner’s Office (ICO) provides a helpful checklist make sure you’ve got a lawful reason for processing the data, clear communication, and strong data security in place. [51] [52]

Recheck Contracts, Licences and Insurance

Go through all existing agreements, client contracts, office leases, supplier deals, insurance cover, and professional licences. Make sure nothing slips through the cracks.

Confirm that your indemnity insurance, cyber cover, and other policies will extend to the merged entity. Note that some licences don’t transfer automatically, so they may need to be updated or reapplied for under the new business structure.

Quick Compliance Checklist

| Area | What to Do |

|---|---|

| Regulatory Bodies | Notify ICAEW/ACCA within 10 days, allow up to 12 weeks for changes |

| Staff Transfers (TUPE) | Inform employees early, protect their roles and terms |

| Data Protection (GDPR) | Transfer data securely, document your legal basis, notify those affected |

| Contracts & Licences | Review all agreements, check insurance and licences cover the new setup |

Post-deal compliance isn’t glamorous, but it’s vital. By planning ahead, filing the right forms, handling data with care, supporting staff, and reviewing your legal documents, you’ll protect your firm and keep everything running smoothly.

Common Mistakes to Avoid

Mergers and acquisitions in the accounting world aren’t just about signing contracts, they demand careful planning and a clear understanding of what not to do.

In fact, research shows that about 80% of failed deals in this sector had the same avoidable issues. Here’s how to stay on the right track:

Rushing Through Due Diligence

Skipping proper checks is one of the biggest mistakes firms make. Hidden debts, dodgy numbers, or poor internal systems can all come back to bite you.

Big-name failures like the HP–Autonomy deal (which ended in an $8.8 billion write-down) show just how costly this can be. Always take the time, usually 6 to 16 weeks for a full and phased due diligence process. [53]

Overlooking Culture and People Fit

Even if the numbers stack up, clashing values or work styles can derail everything. Around half of all accounting firm mergers struggle because the teams simply don’t gel whether it’s due to personality clashes, leadership ego, or completely different ways of working.

Poor Communication with Clients and Staff

If you don’t keep people in the loop, they’ll make their own assumptions and that’s rarely good. Silence creates confusion, anxiety, and in many cases, the loss of key staff or clients.

Start clear and open communication before the deal is signed, and keep it going for at least a year after.

No Real Plan for Integration

Thinking of M&A as a quick transaction, rather than a long-term change, is another common error. Without a detailed plan to merge systems, teams, and processes, things can fall apart fast.

Firms that go in with joint project managers, shared workflows, and a clear plan often see smoother transitions and less staff turnover, some even speed up success by 20–30%.

Focusing Only on Price or Systems

Some deals fail even after getting a ‘good price’ because they weren’t built around a shared purpose. M&A should be seen as a bigger transformation, not just a way to gain new clients or upgrade software.

If both sides don’t agree on the long-term vision, even the most well-structured deal can fall apart once the paperwork’s done.

Avoiding these common traps like rushed checks, clashing cultures, lack of communication, weak planning, or a short-term mindset can make all the difference.

Done right, a merger or acquisition isn’t just about growth on paper. It’s about creating something stronger, smarter, and ready for the future.

Conclusion

Mergers and acquisitions can be powerful tools for accounting firms seeking growth, scale, or succession. The key is strategic alignment, cultural fit, and rigorous execution. Whether merging with a peer or acquiring a retiring firm, success depends on planning ahead, communicating clearly, and managing integration professionally.

Download the Workbook

Now it’s time to take everything you’ve learned and apply it to your own merger or acquisition journey.

Download the workbook below and begin completing each section to build a clear, practical action plan for identifying the right target, assessing fit, structuring a deal, and preparing for a smooth integration.

This workbook is designed to help you move from theory to execution, step by step, so you can reduce risk, increase confidence, and create long-term value for your firm.

Start filling it in now and begin shaping the future of your accounting practice.

Download the Mergers & Acquisitions Workbook

Bibliography

- https://www.icaew.com/technical/practice-resources/evolution-of-mid-tier-accountancy-firms

- https://www.icaew.com/technical/corporate-finance/lead-advisory/mergers-and-acquisitions-analysis-and-deal-drivers

- https://en.wikipedia.org/wiki/Succession_planning

- https://www.investmentnews.com/practice-management/retiring-wealth-managers-keeping-ma-market-hot-study-shows/258937

- https://www.icaew.com/technical/tas-helpsheets/financial-reporting/share-for-share-exchanges

- https://www.icaew.com/technical/tas-helpsheets/financial-reporting/groups-and-consolidated-accounts-under-frs-102

- https://www.icaew.com/technical/practice-resources/regulations-standards-guidance-and-ethics/maintaining-your-firm-record/mergers-acquisitions-and-other-business-changes

- https://www.icaew.com/technical/tas-helpsheets/financial-reporting/share-for-share-exchanges

- https://www.icaew.com/-/media/corporate/files/technical/practice-resources/mergers-and-acquisitions.ashx

- https://www.goingconcern.com/heres-how-mid-tier-accounting-firms-are-feeling-about-private-equity-and-ma/

- https://www.reddit.com/r/Accounting/comments/1fnj7jh/forbes_why_private_equity_is_rushing_to_buy_up/

- https://www.icaew.com/insights/viewpoints-on-the-news/2025/jan-2025/why-the-practice-finance-landscape-is-changing

- https://www.icaew.com/-/media/corporate/files/technical/practice-resources/mergers-and-acquisitions.ashx

- https://www.accaglobal.com/uk/en/member/sectors/smp/shaping-your-practice-exit/planning-your-exit/using-brokers-and-advisers/advisers-brokers-and-you.html

- https://ashley-kincaid.com/buyerclient

- https://www.icaew.com/technical/corporate-finance/corporate-finance-faculty/member-firms

- https://www.cpapracticeadvisor.com/2025/02/26/karbon-practice-marketplace-offers-connection-point-for-firms-seeking-acquisition-with-buyers/

- https://www.icaew.com/insights/viewpoints-on-the-news/2025/jan-2025/why-the-practice-finance-landscape-is-changing

- https://whitetigerconnections.com/blog-post/deal-structures-in-accounting-firm-ma/

- https://www.icaew.com/insights/viewpoints-on-the-news/2025/jan-2025/why-the-practice-finance-landscape-is-changing

- https://poegroupadvisors.com/blog/acquisition-cpa-firms/

- https://www.accountingweb.co.uk/community/industry-insights/top-tips-when-acquiring-a-practice

- https://www.pwc.com/m1/en/media-centre/articles/mergers-and-acquisitions-sell-series-non-disclosure-agreements.html

- https://www.idealsvdr.com/blog/nda-for-mergers-acquisitions/

- https://www.axial.net/forum/deal-confidentiality-ma/

- https://poegroupadvisors.com/blog/due-diligence-phases-in-an-accounting-practice-sale/

- https://www.gggllp.com/financial-due-diligence-for-mergers-and-acquisitions/

- https://www.thecjgroup.com/mergers-acquisitions-7-common-ma-due-diligence-pitfalls/

- https://poegroupadvisors.com/blog/deal-making-ma-observations-on-private-equity-in-the-accounting-industry/

- https://poegroupadvisors.com/blog/cpa-practice-valuation/

- https://toaglobal.com/blog/value-cpa-firm/

- https://peakbusinessvaluation.com/valuation-multiples-for-an-accounting-firm/

- https://jetpackworkflow.com/blog/accounting-firm-acquired-for-11x-ebitda-state-of-ma-and-more/

- https://en.wikipedia.org/wiki/Valuation_using_multiples

- https://peakbusinessvaluation.com/valuation-multiples-for-an-accounting-firm/

- https://futurefirm.co/how-to-value-a-cpa-firm/

- https://macpa.org/news/908721-asking-the-right-questions-is-critical-for-successful-cpa-firm-m-a-2014-05-15

- https://poegroupadvisors.com/blog/deal-making-ma-observations-on-private-equity-in-the-accounting-industry/

- https://poegroupadvisors.com/blog/deal-making-ma-observations-on-private-equity-in-the-accounting-industry/

- https://audit.scot/docs/central/2012/nr_120614_public_body_mergers_guide.pdf

- https://www.icaew.com/technical/practice-resources/regulations-standards-guidance-and-ethics/maintaining-your-firm-record/mergers-acquisitions-and-other-business-changes

- https://www.accaglobal.com/us/en/student/exam-support-resources/professional-exams-study-resources/strategic-business-leader/technical-articles/culture-and-configuration.html

- https://karbonhq.com/resources/accounting-firm-mergers/

- https://www.journalofaccountancy.com/issues/2018/dec/after-merger-culture-of-success/

- https://www.xero.com/us/accounting-software/app-integrations/

- https://www.accountingweb.co.uk/community/industry-insights/is-your-practice-running-you-how-practice-management-software-puts-you

- https://www.getcone.io/blog/canopy-accounting-software

- https://www.wolterskluwer.com/en-nz/solutions/cch-ifirm-apac/practice-manager

- https://ico.org.uk/for-organisations/uk-gdpr-guidance-and-resources/data-sharing/data-sharing-a-code-of-practice/due-diligence/

- https://www.linkedin.com/pulse/mastering-gdpr-compliance-step-by-step-guide-employee-ilia-dubovtsev-tzzqe/

- https://www.komprise.com/blog/best-practices-for-data-management-during-mergers-acquisitions/

- https://vaultinum.com/blog/gdpr-make-sure-your-acquisition-target-is-compliant

- https://www.accountancyage.com/2023/11/24/navigating-the-minefield-of-ma-risks-in-the-accounting-sector/