For Firms

Hire Offshore Accountants: Build Your Global Accounting Team

Cut Costs. Save Time. Scale with Confidence

Build your offshore team in India with Samera Global Offshoring.

Hiring qualified, UK-trained accountants made simple, secure, and scalable.

Struggling to Hire Qualified Accountants in the UK?

Samera Global is your secure, scalable talent pipeline for accountants. We connect you with pre-vetted, UK-trained professionals who are skilled, reliable, and cost-effective.

From bookkeepers and tax specialists to management accountants, we’ll quickly source and shortlist the right candidates. You stay in control – we handle the heavy lifting.

With the right offshore accounting team, you’ll cut costs, free up senior staff, and scale your firm with confidence.

What Does Offshoring

Accounts Mean?

Offshoring isn’t the same as outsourcing. Instead of handing your accounts to a third-party provider, you build a dedicated extension of your own team – based overseas but fully aligned with your business.

Your offshore accountants work only for you, follow your systems, and provide continuity just like in-house staff, but at a fraction of the cost.

Here’s how offshoring works

1

Identify Tasks

Decide which functions to offshore (e.g., bookkeeping, payroll, AP/AR, tax) so your local team can focus on higher-value work.

2

Select a Partner

Work with a trusted offshoring provider to access talent pools in cost-effective regions like India.

3

Recruit & Train

Hire dedicated accountants through your partner and train them on your processes, tools, and standards.

4

Integrate & Manage

Use cloud-based systems and communication tools to collaborate seamlessly as one team.

This gives you the control and quality of in-house staff, combined with the efficiency and cost savings of a global workforce.

What are the benefits of offshoring?

Offshoring your accounting team gives you the control of in-house staff with the flexibility and savings of a global workforce. Instead of struggling with recruitment and high costs in the UK, you can scale faster, save money, and stay focused on clients.

Lower Costs

Hire skilled accountants at competitive offshore rates and free up budget for growth.

Scalability

Scale your team up or down without recruitment delays or overhead costs.

Global Talent Pool

Access pre-vetted accountants with UK accounting experience and a diverse skill set.

Focus on Your Core Business

Let your offshore team handle routine finance tasks so you can focus on growing your business.

24/7 Availability

A dedicated, international team ensures deadlines are met and nothing gets overlooked.

Enhanced Efficiency

Free your senior staff from repetitive tasks and improve turnaround times.

Find Out How Much You Could Save

Want to see the difference offshoring could make for your firm? Our Offshore Calculator shows exactly how much your business could save by building an offshore accounting team with Samera Global.

Step 1:

Choose your currency:

Step 2:

Add the position(s) you would like to offshore:

| Position | Experience (years) | Current Annual Salary (£) | # People Required |

|---|---|---|---|

Calculator Results

Total Current Monthly Salary Bill

0

Total Current Annual Salary Bill

0

Total Monthly Offshore Salary

0

Total Annual Offshore Salary

0

Savings

Monthly Savings

0

Annual Savings

0

Percent Savings

Want to save money for your business by offshoring with Samera?

Book a FREE no-obligation introduction call with an expert to find out how to potentially increase profits for your business.

Book My Free Introduction CallHow Samera Global Helps You Build an Offshore Accounting Team

We’re not an outsourcing company and we’re not an agency - we’re accountants ourselves. With over 25 years in the UK accounting industry, we understand exactly what firms need to scale their operation.

Where others offer cookie-cutter teams, we deliver tailored solutions. We match you with accountants who work solely for you, follow your processes, and grow alongside your business.

Tell us what challenges you face, and we’ll build the right offshore team to solve them - freeing up your time, cutting costs, and helping you focus on clients.

What makes Samera Global different?

- We build dedicated teams, not cookie-cutter solutions.

Your offshore team works only for you, following your SOPs and culture. - We know what accountants really want.

We run our own firm, so we’ve faced the same hiring challenges you have. - We match talent to your needs.

Whether you need a single bookkeeper or a full finance team, we source and tailor the right people. - We support you end-to-end.

From recruitment and onboarding to training and scaling, we stay alongside you.

With Samera, you don’t outsource your work - you build your perfect accounting team.

Accounting Services

You Can Offshore with Samera

Accounts Payable Management

Efficient handling of vendor invoices, payments, and reconciliation processes.

Accounts Receivable Management

Timely invoicing, credit control, and cash application services to optimize cash flow.

Financial Reporting

Preparation of accurate financial statements, analysis, and reporting in compliance with regulatory requirements.

Budgeting and Forecasting

Strategic planning support through budget creation, forecasting, and variance analysis.

Tax Compliance

Ensuring adherence to tax regulations, timely filings, and minimizing tax liabilities.

Payroll Processing

Accurate and timely payroll processing, including tax calculations and statutory compliance.

We cover the full spectrum of accounting and finance roles.

Whether you need one accountant or a full finance team, we tailor a solution that fits your practice and scales with your growth.

How We Work

Our process involves 4 easy steps. From consultation to ongoing training and growth:

Our process.

Simple, seamless, streamlined.

STEP 1

Understanding Your Business

- We meet with you and your team to grasp your business.

- We draft a proposal.

- You approve, and we kick off.

STEP 2

Finding the Right Talent

- Recruitment commences.

- We present shortlisted candidates.

- You conduct interviews.

- You select the best fit.

- We extend the offer and finalize the process.

- We conduce security checks including background and identity verification and reference checks among others.

STEP 3

Training Your New Team

- We facilitate a seamless onboarding process.

- Provide technical training.

- Offer guidance to maximize productivity.

STEP 4

Ongoing Support

- As you settle in, we maintain regular check-ins.

- Your dedicated Account Manager provides continuous support.

- Your offshore team grows alongside your business.

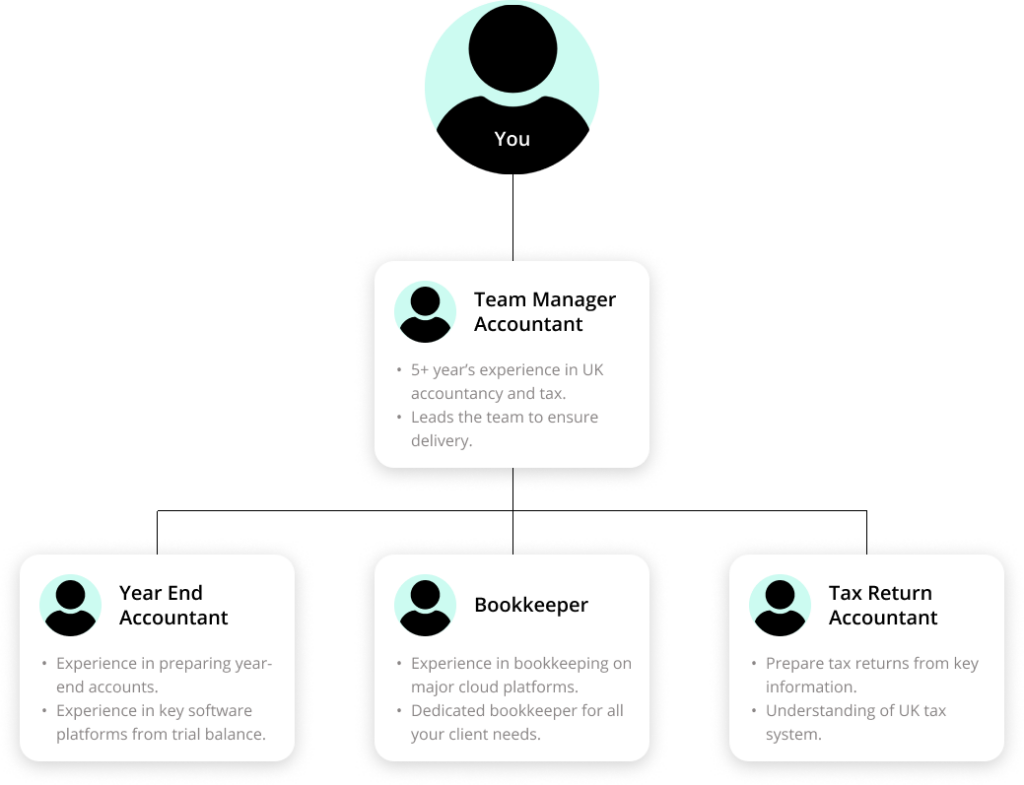

Your Offshore Accounting Team:

Roles, Skills & Structure

Once we understand your situation and needs, we will use our extensive talent pool to build a team of accountants who work for you and align with your goals.

From tax accountants to bookkeepers and everything in between, there's no accounting problem our talent pool can't solve.

Your team will:

- Be trained to a high standard to tackle exactly what you need them for.

- Be an extension of your own business.

- Work solely for you.

- Work to your existing SOP's.

- Grow as your business grows.

Typical Roles Include:

Bookkeeper

Experience

5 years

- Recording Financial Transactions

- Maintaining General Ledger

- Bank Reconciliation

- Accounts Payable and Receivable

- Payroll Processing

- Financial Reporting

- Compliance

Year-End Accountant

Experience

4 years

- Financial Data Processing

- Reviewing Financial Records

- Preparing Financial Statements

- Audit Preparation

- Tax Compliance

- Process Improvement

- Training and Development

Management Accountant

Experience

7 years

- Financial Data Processing

- Accounts Payable and Receivable

- Expense Management

- Payroll Processing

- Financial Reporting

- Variance Analysis

- Budgeting and Forecasting

- Compliance and Audit Support

Tax Accountant

Experience

4 years

- Prepare and review tax returns

- Collaborate with clients

- Ensure compliance with UK tax laws and regulations

- Assist with tax planning strategies

- Prepare and submit tax filings

Payroll Accountant

Experience

4 years

- SSP (Statutory Sick Pay)

- SMP

- Pension Deductions

- Attachment of Earnings

- Starters/Leavers

- PAYE End of Year Procedures

- Input and Submit Pension Data

- Dealing with Tax Year End Submissions

- P60 Issuance

- RTI Submissions

Accounts Assistant

Experience

3 years

- General administration activities

- Requesting information from clients

- AML and KYC processing

- HMRC administration

- File and folder organisation

Once your team is online and working for you, the structure will look like this:

Why Accountants Choose Samera

for Offshoring Support

We are accountants trying to make life easier for the world's accountants.

We're Accountants Too

We run our own UK practice, so we know what you really need.

Qualified Talent, Ready to Work

Every accountant is pre-vetted, UK-trained, and matched to your requirements.

Secure, Compliant & Fully Supported

We handle contracts, HR, and data security to protect your firm and your clients.

Transparent Pricing. No Hidden Fees.

No hidden fees. Scale your team from part-time to full-time with confidence.

We've been in the UK's accounting sector for nearly 30 years.

We’ve faced the same challenges you face today: rising costs, talent shortages, and compliance pressures.

We tried outsourcing. It didn’t work. So we built something better: offshore teams designed for accountants, by accountants.

We prioritise

In everything we do, we prioritise:

- Expertise: Our team comprises seasoned professionals with extensive experience in finance and accounting.

- Cost Efficiency: Outsourcing finance functions can significantly reduce overhead costs and improve profitability.

- Scalability: We offer scalable solutions to adapt to your business growth and changing needs.

- Compliance: Strict adherence to regulatory requirements ensures legal compliance and risk mitigation.

With our help, you'll build an expert, cost-effective team that grows as you grow and ensures your work is completed to the highest level.

Accountants don't want to outsource their work. What they really want is the right team for their work.

That's what we do. We help accountants build the perfect team that works solely for them. A team which aligns with their vision and helps realise their goals.

All you need to do is let us know what problems you are facing and we will find the perfect solution.

Outsourcing Accounts FAQ's

Do you have further questions about outsourcing your accounts?

If you want to ask any questions, please send us a message via our contact form.

Why should I choose Samera over any of your competitors?

We’re accountants ourselves. Unlike agencies, we know the UK accounting landscape firsthand and provide vetted, UK-trained offshore staff who work solely for you.

Our offshore accounts offering is unique in the industry, as we have qualified accountants in the UK and India supporting all our outsourcing client needs. Using expert accountants in both continents will ensure the quality of delivery and communication will be of the highest standard.

We have been at the cutting edge of digital and automated accounts for decades. Our process ensures you and your clients' finances are recorded, processed and managed efficiently and effectively.

How would my practice begin working with you?

Initially, we have a fact-finding meeting before we commence any work. This is vital for us to understand your business or practice, so we can then understand your needs.

We are well versed in mapping out workflows, which will then become the foundation of our outsourcing relationship.

Once we have agreed on the full scope of the work involved we will then propose suitable team members and also technology requirements before we commence any work.

We are a small start-up accounting firm. Will you work with us?

Yes, absolutely. We work with accounting firms of all sizes across the UK and Europe. In fact, many firms have started small with us and grown on to become large, well-established practices. Our friendly UK and India team are available to help firms of all sizes.

We are an accounting practice. How can we trust that you will not take clients away from us?

Our goal is to support you with your accountancy needs – period. As a firm of Chartered Accountants based in the UK, we know all the issues you are facing to run an efficient profitable firm.

Trust is at the heart of what we do, so it is firm-wide policy to support our fellow clients, including accountancy firms. This means we will not approach any of your clients to take on their business.

This is our standard operating procedure. Additionally, our agreement covers all areas of mutual non-competition, non-solicitation and non-disclosure. So, you can trust us 100%.

What is your data security guarantee?

We are fully compliant to GDPR data protection regulations and we are an information commissioner’s office (ICO) registered UK organisation.

We comply with all the latest regulations in managing data and can assure you we have strict controls in place to ensure all your data is protected.

All data remains in the UK, on UK servers.

We are a UK Limited company. We want full-service accounting and to act as our representative for any enquiries. Can you do that?

Absolutely, we can work with you as long as you are not a client of an accounting firm whom we work with.

Our team can manage your bookkeeping, prepare and file your VAT returns, produce monthly management reports, and prepare your yearend accounts. We are registered agents with HMRC and so we can also file your accounts online, as well as manage enquiries from HMRC and Companies house on your behalf. Our expert will fulfill all the necessary statutory requirements for you acting as your accountants.

How competent and qualified are your accounting staff?

All our Indian accountants have several years of accounting experience and are formally qualified at university. They have worked on UK accounting projects for many years. All the new staff are trained for UK accounting rules and regulations by UK-qualified accountants and all work will be fully reviewed by UK-qualified accountants before it reaches you. Our UK accountants are accredited by the ICAEW, ACCA and CIMA.

What are your service terms? What is our commitment to outsourcing engagement?

We work on a monthly basis with all clients and allocate a dedicated staff member for your business needs. We do not offer an hourly-based service. This is because our team needs to work in a fully-integrated manner with your team to offer a seamless process.

Please note that we have a 3-month notice period for all engagements.

Why large companies should choose us.

If you represent a larger corporate, and you want a professional, trustworthy accounts outsourcing firm, do not hesitate to contact us. In addition, we bring in state-of-the-art technology expertise such as robotic process automation, machine learning and artificial intelligence.

You can find out more about why accountants should think about outsourcing their accounts here.

Ready to Offshore

Your First Role?

Or book a free discovery call to see how it works in practice.