Running a growing DSO is like spinning many plates, praying that one plate doesn’t come crashing down, bringing the rest of the plates down.

Having worked with Dentists for the last 24 years, including being actively involved in the running of my wife’s, Smita’s, private dental practices, The Neem Tree Dental Clinics, things don’t appear to be getting easier.

Yet, more dentists want to own their own dental practice, grow a group or gain Private Equity (PE) money and reach the heady heights of a sky-high valuation.

But things have changed over the last few years, and despite there being the desire, it’s a tough ask to build a group.

Running and owning one dental practice is hard enough, running multiple sites is a completely different proposition.

In the good times, the rewards are certainly there to be had.

But in a challenging and changing economic market, with increased competition, factors that were often ignored by groups in the past, need to be factored into survival plans, let alone growth.

Get these wrong, and the dream of a scaling dental group, can be a distant memory as you are stuck knee deep in financial disarray.

An Overview of the Current Dental Market

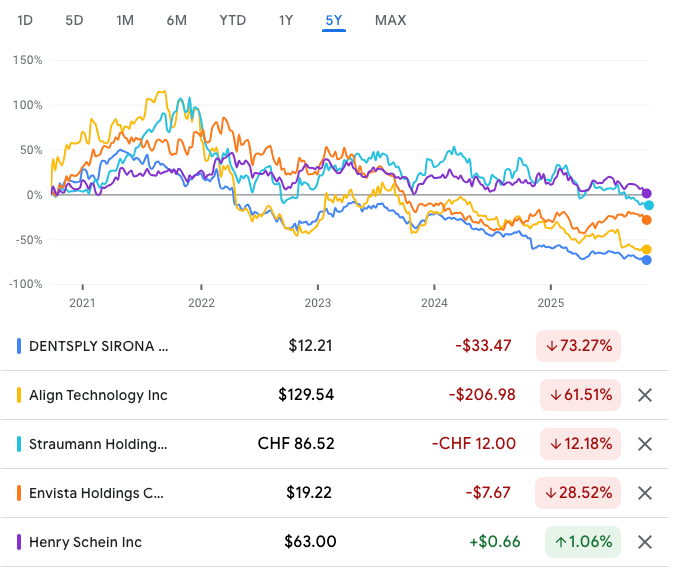

Now, a good starting point to understand the wider dental market is to take a look at some of the large listed dental supply companies, as one can correlate from their share price performance as to how the wider dental market is actually coping. I have chosen a few of the largest listed companies.

The chart below is at 14th October 2025.

All heavily down from the heights of a post-COVID boom, just like many a dental practice or dental group.

Yes, we hear that established groups are now re-emerging to see what they can acquire, but the heady valuations of the post-COVID boom are very different to what may be offered now. Just look at the valuation of MyDentist as Bridgepoint acquired a recent stake in the business – very different to a few years back. See my take on this article on this acquisition on the following link:

https://samera.co.uk/bridgepoint-acquires-mydentist/

The notion that AI will transform groups and the delivery of clinical care has some merit, but certainly not significantly enough for investors to get too excited about!

In my view, the whole business model of delivering dental care as a group has to change.

The idea of acquiring practices at scale with PE money has much-struggled, with many of the larger groups aiming to be listed never coming to fruition in my working life.

But of course, opportunistic players, such as Bridgepoint, who know a thing or two of buying cheap and selling high, give a clear indication that there is money to be made by such short to mid-term investments.

But they are not in it for the patient or the teams, their only premise is to make money.

Period.

So, what should you be doing if you are running or building a dental group or DSO?

A lot.

I’ll leave the clinical side to the experts, as dentists are well-equipped to address that.

It’s the business aspects that many struggle with, so my focus will be on those aspects.

And yes, as a business advisory firm to many dental practices and groups across the world, we have solutions that can help.

1. Manpower

I see this issue in my wife’s small private dental group, The Neem Tree. Finding capable people is difficult. Salaries are rising, taxes and national insurance are higher and the trend only seems upwards.

Yet, to run a dental practice you need qualified and capable people, but with the current immigration issues in the UK, it’s unlikely to be solved quickly.

So, what can you do?

The first goal has to be to build a strong team of clinicians and in-practice team members. Pay well, and attract the best talent.

But, in running a dental group, you will have quite a few centralised overheads, which you want to keep under careful control, whilst still managing an efficient organisation.

This means identifying such roles which don’t require manpower sitting in the UK.

Such roles could include:

- All accounting and bookkeeping roles

- Digital marketing roles

- Video production and editing roles

- Administration and compliance roles

- Software development roles

Many groups historically have struggled as the head office overheads can be too high, bringing down the EBITDA of the group down, often making the idea of a group unworkable.

The only time I have seen head office overheads very low is when the owner of the group basically cuts corners, and has little organisation in place. Making good profits, but totally un-investable for any serious investor.

A strong management team, with the correct head office infrastructure in place to manage the business is key, failing to have this, usually ends in tears.

Solution

Building an offshore team or Global Capability Centre that houses capable individuals that are part of your organisation is a strategic move that will allow groups to grow. A 100% subsidiary company overseas that supports the growth of your core business isn’t a nice to have, but a must today.

If you’re a Global DSO, you can find more info at the link below:

https://sameraglobal.com/global-capability-centers-for-dental-service-organisations

2. Funding

Raising finance in UK dentistry is relatively easy.

Most high street banks are falling over themselves to lend to dentists, as historically they have been a safe bet – usually with personal guarantees in place at quite attractive rates.

The issues start to arise when the borrower wants additional funds for further practices, again, quite often not a problem, because the banks love dentists.

Until they don’t.

A dodgy acquisition, or a poorly structured business, or too much personal expenditure can often add financial and personal stress, so if you are seeking to grow through acquisition, it’s imperative to have the right structure in place from the beginning to be able to truly scale.

Way too many small groups fall at this hurdle as they have a mix of sole trader businesses, partnerships, companies in a mish-mash, with no real clear and coherent strategy for growth.

This makes it difficult for funders to continue funding as a ceiling is reached.

Ultimately, the only option is to secure funding from investors, often on weak terms, sacrificing equity for growth, rather than having a clear investable structure in place in the first place.

Many of the issues that rear their head further down the line, could have easily been solved with some proper planning with the right people in the first place.

Solution

The right advice early on for the optimum group structure is key in funding the growth of your group.

If you are seeking to finance new acquisitions or need some help with refinancing existing debt, learn how we can help below:

https://samera.co.uk/service/business-loans/

3. Data

Too much data in dentistry sits in silo’s.

Clinical data in one system, financial data in another system, marketing data in another system.

And much of the data entry has been poorly executed, leading to questionable outputs. Garbage in equals garbage out!

With so much commercial information available, many of the answers groups are seeking answers to, lie in the data, you just need to know where to look and what to ask!

The forward-thinking groups have already identified this as a growth limiter, and are now working out their best paths to analysing the data to help with improved decision-making.

Better data understanding leads to greater valuations.

Solution

As solution providers to dental groups we are building tools that provide great insight for DSO’s – you can read further about this on the link below:

https://samera.ai/ai-automation-for-dental-practices/

Register your interest to find out more as we develop the next generation of data analytics tools for DSO’s.

4.Tax structures

I think I have had the question “How can I save more tax?” from dentists more than hot dinners!

Well, okay, that may be an exaggeration, but the number is excessively high, and the same goes for dental groups too!

But the mistake so many groups make is having a poor tax structure in the first place.

Remember the issue of some groups being a mish-mash of sole traders, partnerships and limited companies, making it difficult to fund expansion? Well, the same mish-mash causes poor tax outcomes too.

Poor tax planning ultimately catches up.

A well thought out group tax structure when starting can save many thousands of £££’s.

A lack of, or just poor tax planning often also leads to poor tax-making decisions.

Sadly, we have seen many dentists being sold questionable “tax-saving schemes”, often falling foul of HMRC – usually leading to very costly mistakes.

The focus should be on growing a successful group and increase profits, but too many dentists have an unhealthy obsession to save tax, rather than grow EBITDA and the ultimate exit valuation.

Solution

Seek proper advice on tax, you know where to come, but if unsure this is the link below to find out more!

https://samera.co.uk/service/dental-accountants/

5. Accounting and Bookkeeping

Okay, I know this may make you yawn, but accounting is the foundation of a successful business. Knowing the numbers are being recorded properly feeds everything else to aid with your decision-making.

Yet so many groups have such a poor grip of this area, the blind leading the blind.

Poor bookkeeping by unqualified manpower, weakens the foundation of a group.

Investing in the right accounting systems, accruals-based accounting (not cash accounting!!), improve efficiency, and aid with a much better understanding of performance.

Solution

Understanding, analysing and making decisions around the numbers is key to growing a successful group. Yet many DSO’s lack the expertise in-house.

We offer a CFO service for growing groups, you can learn further on the link below:

https://samera.co.uk/service/dental-cfo-services/

6. Cash flow

It’s a lack of cash flow that ultimately kills a business not a loss making business.

Of course cash generation in the business is essential but also ensuring you have funders or investors in place to support you when things go awry – which they often do.

Closely watching cash flow, and predicting it going forward is critical to any growing group.

Poor visibility here ultimately leads to difficult decisions.

Solution

Having a CFO on hand is again key here, as the right systems will be in place, along with strong interpretation of the data will help you navigate any financial issues that may crop up:

https://samera.co.uk/service/dental-cfo-services/

7. Owner vs Operator

The true test of the success of a dental group is proven when the high-grossing owner(s) stops doing any dentistry.

It’s at this point one can really see if you have a real business or one that has been supported by the clinical earnings of the owner.

Is the business system driven, or dependent on a few key dentists?

What would happen if you or they stopped dentistry? Are the margins still strong?

Solution

Building a group NOT reliant on a few key personnel is key, but before you do this you have to have a full understanding of the numbers in your DSO.

This means, building a global capable team that can be your centralised function, investing in the right financial systems to give you the insight you require, and developing data driven tools that can provide you the answers.

Conclusion

In the next 3 years, I believe, DSOs that embrace financial clarity, build a capable financial team and strong financial processes combined with clinical excellence AND a great team culture, will be the ones rewarded with a high valuation.

The rewards are certainly there, but they come with many risks, and in my view, the key is being able to keep all plates (practices) spinning even in rocky times.

You have been warned!