How much can you save with an offshore accountant?

UK Accounting Industry Report

Delve deep into the key challenges and opportunities currently reshaping the UK accounting industry.

- Introduction – The Tides of Change

- The UK Accounting Industry: An Overview

- 5 Reasons for Players to Identify Challenges and Opportunities in the UK Accounting Industry

- 4 Imminent Challenges Confronting the UK Accounting Industry

- 3 Potential Opportunities Presenting a Competitive Leap

- The Takeaway

Introduction – The Tides of Change

In the ever-evolving world of finance, where numbers and figures paint a story of economic prowess, one sector remains at the heart of every successful enterprise: the accounting industry.

Research shows that in 2022, the UK accounting and auditing industry captured a market size of £6.4bn [1]. From local businesses to multinational corporations, accountants serve as the steadfast guardians of financial health and integrity.

However, in today’s fast-paced, tech-driven landscape, the UK accounting industry finds itself on the cusp of a transformation, surrounded by a myriad of challenges and opportunities that demand our undivided attention.

Now, more than ever, accountants must navigate a complex web of factors that shape the very foundations of their profession. The financial landscape is rapidly shifting, driven by technological advancements, regulatory changes, and a globalized economy. To thrive amidst this sea of change, accountants need to not only adapt but also embrace these challenges and seize the accompanying opportunities with unwavering determination.

This piece delves deep into the key challenges and opportunities currently reshaping the UK accounting industry. It aims to equip both seasoned professionals and aspiring accountants with the insights needed to stay ahead of the curve. From the adoption of innovative technologies to the changing regulatory landscape, we will explore how these factors are revolutionizing the way accountants operate and providing a platform for growth and innovation. We will also shed light on the challenges brought forth by these advancements, such as concerns about job displacement and the ethical implications of relying on machines to make crucial financial decisions.

Further, we will explore the regulatory shifts in the UK that demand accountants’ utmost vigilance, from the intricacies of tax legislation to the growing emphasis on sustainability and environmental reporting. We will uncover how these changes are not only creating challenges but also opening up new avenues for accountants to provide value-added services and become trusted advisors to their clients.

To navigate the tumultuous waters ahead, it is imperative that professionals in the UK accounting industry grasp the challenges and opportunities at hand. By staying informed, adapting to emerging trends, and embracing technological innovation, accountants can position themselves at the forefront of this transformative era.

Whether you’re an established accountant seeking to stay ahead in an ever-evolving landscape or an aspiring professional eager to understand the industry’s future, join us on this journey as we unravel the key challenges and opportunities shaping the UK accounting industry.

Become a Smarter Accountant for Free

Join “The Margin” our Newsletter for Business Tips for Accountancy Firms.

The UK Accounting Industry: An Overview

The UK accounting industry stands as a critical pillar of the nation’s economic prowess, providing invaluable services that ensure financial transparency, compliance, and strategic decision-making for businesses of all sizes. With a rich history and a reputation for excellence, the UK accounting sector plays a vital role in driving economic growth and stability.

However, the landscape is rapidly evolving, presenting both challenges and opportunities that demand our attention.

In this part, we will embark on a journey to explore the current state of the UK accounting industry, shedding light on key insights and statistics that underscore the need to proactively anticipate its future trajectory.

Running a Global Accountancy Firm in 2023

The Scale of the Industry

To comprehend the significance of the UK accounting industry, we must first grasp its immense scale. As of the latest available data, the sector boasts over 415,000 professionals across the world, encompassing a wide array of roles and specializations [2]. From chartered accountants to auditors, tax advisors to management accountants, these skilled individuals form the bedrock of financial integrity and expertise in the UK.

Contribution to the Economy

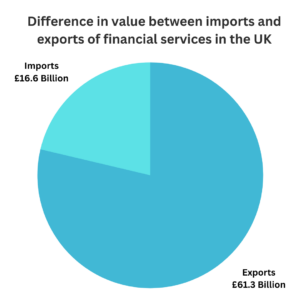

Beyond its sheer size, the UK accounting industry plays a pivotal role in bolstering the nation’s economy. A recent report by the UK government reveals that financial services, which include the accounting industry, contributed a staggering £173.6 billion to the UK’s gross value added (GVA) in 2021, accounting for approximately 8.3% of the country’s total economic output [3]. This highlights the industry’s profound impact on the overall economic landscape, underscoring the need for a proactive approach to adapt and thrive amidst evolving challenges. In 2021, the UK made £61.3 billion by exporting financial services, and spent £16.6 billion on importing financial services, a trade surplus of £44.7 billion in financial services.

Technological Transformation

Technology has become a driving force reshaping the UK accounting industry. Automation, artificial intelligence (AI), and cloud computing have revolutionized traditional accounting processes, streamlining workflows, enhancing accuracy, and reducing costs. According to a survey conducted by the Institute of Chartered Accountants in England and Wales (ICAEW), 93% of accountants believe that technology will significantly impact their profession in the coming years [4]. Further, around 51% accountants believe that technology can emerge as a real competitive lever in providing financial advisory to their client [5]. The implementation of cloud accounting systems alone has surged immensely in recent years, transforming the way accountants handle financial data and enabling real-time collaboration with clients.

The Impact and Challenges of AI on Accounting Outsourcing

Growing Need for Data Analytics

Data analytics has emerged as a game-changer within the accounting industry. With vast amounts of financial data at their fingertips, accountants now have the power to extract actionable insights that drive strategic decision-making. By leveraging advanced analytics tools, accountants can uncover patterns, trends, and anomalies, enabling them to provide valuable recommendations to their clients. It is estimated that data analytics can improve a firm’s profitability by up to 60% [6], further emphasizing the need for accountants to embrace this transformative technology.

Regulatory Challenges and Opportunities

The UK accounting industry faces a dynamic regulatory environment, with changes in tax legislation, financial reporting standards, and regulatory oversight constantly shaping the profession. For instance, the implementation of Making Tax Digital (MTD) by HM Revenue and Customs (HMRC) has mandated digital record-keeping and reporting for VAT-registered businesses, driving the adoption of cloud accounting systems. Additionally, the growing focus on environmental sustainability has paved the way for accountants to provide guidance on carbon reporting and sustainable finance initiatives, positioning themselves as key players in a rapidly changing landscape.

By recognizing the snapshot of the industry and the forces propelling its evolution, professionals can navigate the dynamic landscape with confidence, positioning themselves as trusted advisors and catalysts for financial success. Over the length of this article, we will delve deeper into the key challenges and opportunities facing the UK accounting industry, uncovering strategies to stay ahead of the curve and unlock new realms of growth and innovation.

Become a Smarter Accountant for Free

Join “The Margin” our Newsletter for Business Tips for Accountancy Firms.

5 Reasons for Players to Identify Challenges and Opportunities in the UK Accounting Industry

In the rapidly evolving landscape of the UK accounting industry, staying ahead of the curve is not just a luxury; it’s an absolute necessity. As the profession faces a plethora of challenges, it is crucial for accountants to address them head-on while simultaneously embracing the many opportunities that lie within.

By acknowledging the importance of proactive adaptation and seizing these opportunities, accounting professionals can pave the way for future success and secure their position as trusted advisors in a transformative era.

- Staying Competitive: Identifying challenges and opportunities allows players in the UK accounting industry to stay competitive in a rapidly evolving landscape. By proactively addressing challenges, they can adapt their services, processes, and technologies to meet client expectations and stand out from the competition.

- Fostering Innovation: Recognizing challenges and opportunities stimulates innovation within the accounting industry. It encourages professionals to explore new technologies, methodologies, and business models that can enhance efficiency, accuracy, and client satisfaction. Embracing opportunities for innovation can lead to groundbreaking advancements and novel approaches to delivering accounting services.

- Meeting Client Needs: Identifying challenges and opportunities helps players align their services with changing client needs and preferences. By understanding emerging trends, technological advancements, and regulatory requirements, accountants can proactively anticipate client demands and provide tailored solutions. This strengthens client relationships and ensures long-term satisfaction.

- Navigating Regulatory Landscape: The accounting industry operates within a complex regulatory framework. Identifying challenges related to regulatory changes and compliance requirements allows players to stay ahead of potential risks and ensure adherence to evolving standards. By understanding and addressing these challenges, accountants can maintain professional integrity and avoid legal complications.

- Penetrating Growth Whitespaces: Recognizing opportunities within the UK accounting industry enables players to seize avenues for growth and expansion. Whether it’s through diversifying service offerings, expanding into emerging markets, or capitalizing on technological advancements, identifying and embracing opportunities allows accountants to unlock new revenue streams and enhance their market position.

In the next section, we will look into the specific challenges that accountants face and explore strategies to overcome them. From technological disruptions to regulatory complexities, we will navigate the intricacies of the UK accounting industry, shedding light on how professionals can navigate these challenges to thrive in the changing landscape.

Become a Smarter Accountant for Free

Join “The Margin” our Newsletter for Business Tips for Accountancy Firms.

4 Imminent Challenges Confronting the UK Accounting Industry

Challenge #1: Technological Disruption

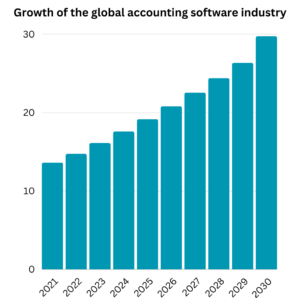

The global accounting software market is forecasted to grow at a CAGR of 9.2% from 2023-2030, which would see it touch a massive 30 billion USD by then [7]. As the gears of innovation turn with relentless speed, accountants find themselves at the edge of a technological revolution. With each passing day, cutting-edge technologies like automation, artificial intelligence, and data analytics reshape the landscape, challenging the status quo and birthing a new era of possibilities.

Emerging technologies such as automation, AI, ML, and data analytics are reducing turnarounds for accountants, optimizing processes, enabling better team play, and translating data into decisions.

Yet, amidst the allure of this brave new world, challenges emerge on the horizon. Ethical dilemmas, job displacement concerns, and the need for upskilling cast a shadow over this technological utopia. As machines grow more sophisticated, questions of accountability and the ethics of automated decision-making loom large. Accounting firms must navigate this complex terrain, ensuring the integrity and transparency of their practices in the face of automation’s allure.

In the depths of this technological disruption, the accounting industry finds itself at a crossroads. Will it embrace the transformative power of technology and emerge as a shining beacon of innovation? Or will it tread too cautiously, risking irrelevance in a world that demands agility and adaptation? In the forthcoming sections, we try to answer these questions and unveil strategies to harness the power of technology to propel the industry into an era of unprecedented possibilities.

Impact of Emerging Technology on the Accounting Industry

Technology has become the catalyst that disrupts traditional practices, reshaping the landscape and propelling the industry into a new era of efficiency, innovation, and strategic insights. As automation, artificial intelligence (AI), and data analytics take center stage, the impact of technology on the accounting profession is nothing short of revolutionary.

In this section, we delve into the tangible ways technology is reshaping the accounting industry, unlocking unprecedented opportunities, and redefining the role of accountants.

Streamlining Efficiency and Accuracy

With the advent of robust accounting software, tasks like data entry, reconciliation, and report generation are seamlessly executed, saving countless hours previously spent on manual labor. As a result, accountants can focus on higher-value activities such as data analysis, strategic planning, and providing personalized insights to clients.

Automated processes not only enhance efficiency but also significantly reduce the likelihood of human error. According to a study, automation in bookkeeping and invoicing processes can help reduce error rates by 60% – 90%, ensuring the accuracy and integrity of financial data [7]. By eliminating tedious tasks and minimizing the risk of errors, automation empowers accountants to deliver faster, more reliable, and error-free services to their clients.

Augmenting Decision-Making Capabilities

Artificial intelligence is a game-changer within the accounting industry, augmenting decision-making capabilities and transforming the role of accountants. AI algorithms can process vast amounts of financial data, extract patterns and insights, and provide real-time analysis. This empowers accountants to make informed decisions and offer strategic guidance to clients.

AI-powered technologies, such as machine learning algorithms, can predict trends, identify anomalies, and optimize financial processes. For example, AI can analyze historical financial data to forecast future performance, identify cost-saving opportunities, and mitigate risks. By harnessing the power of AI, accountants can deliver data-driven insights, support strategic decision-making, and offer invaluable guidance to their clients.

Turning Insights into Action

Data analytics has emerged as a powerful tool for accountants, enabling them to transform raw financial data into actionable insights. By utilizing advanced analytics tools and techniques, accountants can identify trends, correlations, and patterns within financial data that were previously undetectable.

With data analytics, accountants can provide clients with valuable insights on cost optimization, revenue generation, and risk mitigation. They can uncover hidden opportunities, assess the financial health of businesses, and guide strategic decision-making. By harnessing the potential of data analytics, accountants become trusted advisors, equipped with the ability to deliver strategic insights that drive business growth and success.

Enabling Better Collaboration and Access

Cloud computing has revolutionized how accounting professionals store, manage, and access financial data. Cloud-based accounting systems offer collaborative platforms where accountants and clients can work together in real time, seamlessly sharing information and collaborating on financial processes. This enhanced accessibility and collaboration enable accountants to provide timely support, address client concerns, and deliver personalized services.

Moreover, cloud-based solutions offer scalability, data security, and cost-efficiency. Accountants can easily scale their operations to accommodate growing client needs without investing in expensive infrastructure. Data security measures implemented by cloud service providers ensure the confidentiality and integrity of financial information.

Challenges and Mitigators of Emerging Technology

In the rapidly evolving landscape of the UK accounting industry, the successful transition to and leveraging of emerging technologies is key to staying competitive and delivering value in the digital age. In this section, we explore the implications of these emerging technologies on the UK accounting industry, shedding light on their potential impact and empowering businesses to navigate the changing tides with confidence.

Automation

Challenge: Job Displacement and Reskilling – The widespread adoption of automation in accounting processes can lead to concerns about job displacement. Automation streamlines repetitive tasks, potentially reducing the need for certain roles. This presents a challenge for accountants to adapt and reskill to take on higher-value tasks that require critical thinking, data analysis, and strategic decision-making.

Mitigation: Accountants should proactively embrace automation and focus on developing skills in areas that complement automated processes. This includes data analysis, business advisory, and interpreting insights derived from automated systems. Reskilling efforts, continuous learning, and professional development programs can help accountants thrive in an automated landscape.

Artificial Intelligence (AI)

Challenge: Ethical Considerations and Decision Accountability – The increasing use of AI in accounting raises ethical considerations. Accountants need to grapple with questions around the accountability of AI-driven decisions and ensure transparency and fairness in algorithmic processes. The potential biases and lack of human judgment in AI systems can pose challenges in maintaining ethical standards and client trust.

Mitigation: Establishing ethical guidelines and best practices for AI usage in accounting is crucial. Accountants should critically evaluate the algorithms they employ, promote transparency in decision-making processes, and ensure algorithms are regularly audited for fairness and accountability. Incorporating human oversight and ethical review committees can help address these challenges.

Blockchain

Challenge: Integration and Standardization – While blockchain technology offers enhanced security and transparency, its widespread adoption in the accounting industry requires integration with existing systems and standardization of practices. Incorporating blockchain into accounting processes may pose initial implementation challenges, including interoperability with legacy systems and ensuring compliance with regulatory frameworks.

Mitigation: Accounting firms should assess the suitability of blockchain technology for their specific needs and explore partnerships with technology providers to ensure seamless integration. Collaboration within the industry to establish standards and frameworks for blockchain adoption can help mitigate integration challenges and facilitate a smooth transition.

Data Analytics

Challenge: Data Quality and Interpretation – The increased reliance on data analytics in accounting brings challenges related to data quality and interpretation. Ensuring the accuracy, completeness, and reliability of the data used for analysis can be a hurdle. Additionally, interpreting complex analytics outputs and deriving meaningful insights from vast amounts of data require specialized skills and expertise.

Mitigation: Accounting firms should establish robust data governance practices, including data validation, data cleansing, and ensuring data integrity. Investing in data analytics training for accountants and hiring professionals with expertise in data analysis can address the challenge of interpreting analytics outputs and deriving actionable insights.

The Way Ahead

The impact of technology on the accounting industry is undeniable. Technology has transformed the accounting industry – unlocking unprecedented opportunities and redefining the role of accountants. As professionals embrace these technological advancements, they must also adapt their skills, continuously learn, and evolve to remain at the forefront of the industry. The future of accounting is technology-driven, and those who harness its power will unlock a world of possibilities, enabling them to thrive in a rapidly changing business landscape.

Challenge #2: Talent Acquisition and Retention

As businesses expand globally and seek cost-effective solutions, the demand for skilled accounting professionals continues to surge. However, the UK faces a skills shortage and talent gap, posing significant hurdles for organizations striving to meet client needs and maintain competitive advantage. In fact, the ICAEW reports that since the pandemic and Brexit, the UK has incurred a shortage of 330,000 in their workforce [8].

In this section of the article, we delve into the pressing need to address these challenges, focusing on strategies to attract, acquire, and retain top talent within the UK accounting field.

Skills Shortage and Talent Gap

The accounting industry in the UK grapples with a persistent skills shortage and talent gap. The demand for accountants outpaces the supply of qualified professionals, creating a significant recruitment challenge for organizations. As the complexities of accounting evolve and client expectations increase, there is a growing need for accountants with specialized expertise in areas such as tax advisory, forensic accounting, and financial analysis. Bridging this gap requires concerted efforts to attract and develop talented individuals.

The Manpower Challenge for Accountancy Firms in 2023

Competitive Market Dynamics

The UK accounting industry operates within a fiercely competitive market. Accounting firms, as well as corporations with in-house accounting departments, vie for the same pool of skilled professionals. This intensifies the talent acquisition challenge, as organizations must differentiate themselves to attract top talent. The competitive market dynamics necessitate strategic talent acquisition and retention strategies to build a workforce that can deliver high-quality services and drive business growth.

Evolving Skillsets and Technological Advancements

The accounting profession is undergoing a seismic shift, driven by rapid technological advancements and evolving client expectations. Traditional accounting tasks are increasingly automated, demanding accountants to upskill and acquire new competencies. Proficiency in data analytics, cloud accounting, artificial intelligence, and cybersecurity is now essential to stay relevant in the industry. However, the scarcity of professionals with these skills compounds the talent challenge, requiring organizations to invest in training and development programs to equip their workforce with the necessary expertise.

Employer Branding and Attraction

To overcome the talent shortage, organizations must focus on building a strong employer brand and fostering an attractive workplace culture. A compelling employer brand serves as a magnet, drawing in skilled professionals who align with the organization’s values and vision. Emphasizing career development opportunities, work-life balance, and a supportive work environment can differentiate an organization in the competitive talent landscape. Investing in employer branding initiatives and cultivating a positive employer reputation can help attract top talent to the UK accounting industry.

Retention and Career Progression

Retaining top talent is as crucial as acquiring it. Organizations must prioritize employee engagement, recognition, and career progression to retain skilled professionals within the accounting field. Offering clear pathways for growth, providing mentorship and training opportunities, and implementing performance-based incentives can nurture a sense of loyalty and commitment among employees. By fostering a supportive and fulfilling work environment, organizations can reduce turnover and retain valuable talent.

The UK accounting industry faces significant challenges in talent acquisition and retention due to skills shortages and talent gaps. To tackle these challenges head-on, organizations must adopt a multi-faceted approach. By addressing the talent challenge, the UK accounting industry can cultivate a strong workforce, meet client needs, and position itself as a hub of excellence in the global accounting outsourcing and offshoring business.

In the next section, we double down on how UK accounting firms can attract and retain top talent, and ensure sustainable growth and success in the dynamic and ever-evolving landscape of the accounting industry.

Strategies for Attracting and Retaining Top Talent

In the competitive landscape of the UK accounting industry, attracting and retaining top talent is crucial for organizations seeking to thrive and deliver exceptional services to clients. Skilled accounting professionals are in high demand, and the industry faces the challenge of bridging the talent gap. To overcome this hurdle, implementing effective strategies is essential.

In this chapter, we explore five key strategies that the UK accounting industry needs to embrace to attract and retain top accounting talent.

Develop Strong Employer Branding

Building a compelling employer brand is paramount for attracting top accounting talent. Organizations should showcase their values, work culture, and career development opportunities. Highlighting a supportive and inclusive work environment, emphasizing work-life balance, and offering competitive compensation packages can enhance the appeal of the organization. Engaging in employer branding activities such as social media campaigns, participating in industry events, and showcasing employee success stories can elevate the organization’s reputation as an employer of choice.

Foster Continuous Learning and Professional Development

Accounting professionals value opportunities for growth and development. To attract and retain top talent, organizations should invest in continuous learning and professional development programs. Offering training sessions, workshops, and access to industry certifications can enhance the skills and knowledge of accountants. Mentoring programs and career progression pathways can provide a clear roadmap for advancement within the organization. By demonstrating a commitment to employee growth, organizations create an environment that encourages talent to thrive and stay invested.

Embrace Technological Advancements

The accounting industry is rapidly evolving, driven by technological advancements. Organizations need to stay ahead by embracing and leveraging technology. Providing accountants with access to cutting-edge tools, software, and systems enables them to deliver high-quality services efficiently. Emphasizing training in areas such as data analytics, cloud accounting, and automation equips accountants with the skills necessary to excel in a technology-driven environment. By embracing technology, organizations not only attract top talent but also create an innovative workplace culture that fosters growth and efficiency.

Prioritize Work-Life Balance and Flexibility

Work-life balance and flexibility are highly valued by accounting professionals. Organizations that prioritize these aspects can attract and retain top talent. Offering flexible work arrangements, such as remote work options and flexible working hours, demonstrates a commitment to employee well-being. Additionally, providing adequate leave policies and promoting work-life integration initiatives help create a supportive and inclusive work environment. Striking a balance between professional commitments and personal responsibilities enhances job satisfaction and strengthens employee loyalty.

Cultivate a Positive Organizational Culture

Organizational culture plays a crucial role in attracting and retaining top accounting talent. Fostering a positive culture that values collaboration, open communication, and teamwork can create a sense of belonging and engagement. Encouraging a healthy work environment where ideas are welcomed, employees are recognized for their contributions, and transparent communication is promoted cultivates a positive culture. Regular team-building activities, social events, and employee recognition programs further strengthen the sense of community within the organization.

Conclusion

Attracting and retaining top accounting talent is a key challenge in the UK accounting industry. By implementing strategic initiatives, organizations can position themselves as employers of choice and create an environment that appeals to top accounting professionals. By investing in the above-mentioned strategies, the UK accounting industry can build a robust workforce, deliver exceptional client services, and establish itself as a hub of excellence in the field of accounting.

Challenge #3: Evolving Client Expectations

As clients become more sophisticated and demand greater value from accounting services, the industry must adapt to stay ahead. Failure to address these shifting expectations can lead to client dissatisfaction, loss of business, and reduced competitiveness. One trend signaling evolved client expectations is that besides auditing, tax management, and accounting services, businesses are fast adapting to provide financial advisory services to clients, which are fast becoming the most sought-after service.

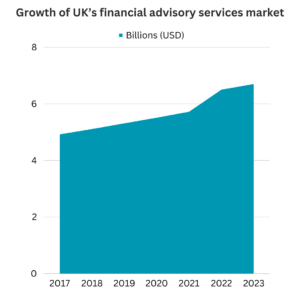

To understand how this trend has developed, we can point out that the market size of the financial advisory industry reached £6.5bn in 2022, going up by a rate of 7.2% in 2022, increasing faster than the rest of the UK’s economy combined [9].

In this section, we explore the sub-challenges that ensue from evolving client expectations and delve into potential mitigation strategies for the UK accounting industry.

Demand for Real-Time Insights

Sub-Challenge: Clients increasingly expect real-time insights into their financial data, requiring accounting firms to provide up-to-the-minute information and analysis. Traditional periodic reporting may no longer suffice.

Mitigation Strategy: Implement cloud-based accounting systems and collaborative platforms that enable real-time data sharing. Embrace automation and data analytics to provide on-demand reporting and analysis. Regularly communicate with clients to understand their information needs and tailor reporting accordingly.

Desire for Value-Added Services

Sub-Challenge: Clients now seek more than just basic accounting services. They expect value-added insights, proactive advice, and assistance with strategic decision-making. Simply fulfilling compliance requirements is no longer enough.

Mitigation Strategy: Invest in staff training and upskilling to develop expertise in specialized areas such as tax planning, financial forecasting, and business advisory. Cultivate a client-centric approach that focuses on understanding each client’s unique needs and delivering tailored, value-added services. Regularly communicate with clients to identify opportunities for improvement and expansion of services.

Emphasis on Technology Integration

Sub-Challenge: Clients expect accounting firms to leverage technology effectively to streamline processes, improve efficiency, and enhance service delivery. Failure to embrace technology can result in a perception of being outdated and hinder the ability to meet client expectations.

Mitigation Strategy: Embrace emerging technologies such as automation, artificial intelligence, and data analytics to optimize accounting processes. Invest in robust technology infrastructure and ensure staff are trained in utilizing technology effectively. Continuously monitor technological advancements and adopt innovative solutions that align with client needs.

Increasing Data Security Concerns

Sub-Challenge: Clients are increasingly concerned about data security and privacy. They expect accounting firms to have robust measures in place to protect their sensitive financial information from breaches and cyber threats.

Mitigation Strategy: Establish stringent data security protocols and adhere to relevant regulations such as the General Data Protection Regulation (GDPR). Implement strong encryption, firewall, and authentication measures to safeguard client data. Regularly conduct security audits and educate staff on cybersecurity best practices.

Need for Enhanced Communication and Transparency

Sub-Challenge: Clients desire transparent and frequent communication with their accounting firms. They expect prompt responses, proactive updates, and clear explanations of financial information and processes.

Mitigation Strategy: Foster a culture of open communication and establish clear lines of communication with clients. Provide regular updates, respond promptly to queries, and proactively share relevant information. Utilize client portals or collaborative tools for seamless communication and document sharing.

Conclusion

Evolving client expectations pose significant challenges for the UK accounting industry. By recognizing and addressing these sub-challenges, organizations can strengthen client relationships, maintain a competitive edge, and thrive in a rapidly changing landscape. With a future-proof strategy in place, the UK accounting industry can position itself as a trusted partner, delivering exceptional services that meet and exceed client needs in an ever-changing business environment.

6 Ways Accounting Outsourcing Firms Can Tackle Evolving Client Expectations

5 Reasons to Prioritise Providing Value-Added and Personalized Services

World over in the accounting industry, the traditional role of accountants has evolved from merely crunching numbers to becoming strategic advisors. As client expectations rise, accounting firms face the imperative of providing value-added services and personalized solutions to remain competitive and thrive as successful businesses.

In this chapter, we explore five compelling reasons why the UK accounting industry must focus on delivering value-added services and tailored solutions to clients, securing their position as trusted partners and drivers of business growth.

Meeting Evolving Client Expectations

Client expectations have evolved significantly over the years. Today’s clients demand more than just basic accounting services; they seek proactive advice, real-time insights, and personalized solutions that cater to their unique needs. By offering value-added services, such as tax planning, financial forecasting, and business advisory, accounting firms can meet these evolving expectations and solidify their relevance in the modern business landscape.

Differentiation in a Competitive Market

The UK accounting industry is fiercely competitive, with numerous firms vying for the same pool of clients. Providing value-added services allows accounting firms to differentiate themselves from competitors. By offering specialized expertise, innovative solutions, and customized support, firms can carve a niche for themselves and stand out in a crowded marketplace. Differentiation through value-added services enhances the firm’s brand reputation and attracts new clients seeking exceptional and tailored solutions.

Strengthening Client Relationships

Value-added services foster stronger client relationships built on trust and confidence. When accountants go beyond the basics and provide insightful recommendations, clients perceive them as trusted advisors and partners in their financial journey. By demonstrating a genuine interest in their clients’ success and actively contributing to their growth, accounting firms cultivate long-term, loyal relationships that can withstand market fluctuations and economic uncertainties.

Enhancing Business Performance

Tailored solutions and value-added services directly contribute to enhancing clients’ business performance. Financial forecasting, strategic planning, and risk analysis empower clients to make informed decisions and optimize their operations. By contributing to their clients’ success, accounting firms become indispensable allies, driving improved financial outcomes and increased efficiency for their clients.

Expanding Revenue Streams

Value-added services open avenues for additional revenue streams beyond traditional accounting services. As clients recognize the value in specialized advice and support, they are willing to invest in these services, boosting the firm’s revenue. Offering personalized solutions tailored to clients’ unique challenges can lead to upselling opportunities and ongoing advisory relationships, increasing the firm’s profitability and sustainability.

Conclusion

In an era defined by evolving client expectations and fierce competition, the UK accounting industry must adapt to thrive as successful businesses. Becoming trusted a strategic advisor positions accounting firms at the forefront of their clients’ financial success and secures their position as key players in the dynamic landscape of the UK accounting industry. Embrace the power of value-added services and personalized solutions, and set your firm on a path to lasting success and competitiveness.

Adopting Client-Centric Technologies and Strategies

As mentioned in the last two sections of this chapter it’s clear that clients now demand personalized and real-time insights, proactive advice, and efficient communication. To meet these expectations and remain competitive, accounting firms must leverage innovative technologies that prioritize client needs. In this chapter, we explore the imperative for the UK accounting industry to embrace client-centric approaches and list key technologies that can facilitate this transition.

The Need for Client-Centric Adoption

In today’s dynamic business landscape, clients expect more than just compliance-focused accounting services. They desire tailored solutions, immediate access to financial data, and strategic advice that aligns with their unique goals. Embracing client-centric technologies and strategies is the key to retaining clients, building lasting relationships, and positioning accounting firms as trusted advisors. By prioritizing client needs and adopting innovative technologies, the UK accounting industry can elevate service delivery, enhance communication, and drive client satisfaction to new heights.

5 Client-Centric Technologies to Stay Ahead of the Curve

1. Cloud-Based Accounting Solutions

Cloud-based accounting software enables real-time access to financial data, facilitating collaboration between accountants and clients. This technology allows seamless sharing of documents and insights, ensuring clients have instant access to their financial information whenever they need it. Cloud-based solutions also promote efficient communication and allow accountants to offer timely advice and support, meeting the demand for immediate insights.

2. Data Analytics and Business Intelligence

Data analytics and business intelligence tools empower accountants to provide value-added insights to clients. These technologies enable the analysis of large datasets, identifying trends, patterns, and opportunities for business growth. By leveraging data analytics, accounting firms can offer strategic advice, helping clients make informed decisions and optimize their financial performance.

3. CRM (Customer Relationship Management) Systems

CRM systems enable accounting firms to centralize client information, interactions, and preferences. By harnessing CRM technology, firms can enhance client engagement, track client communications, and provide personalized services. CRM systems streamline client relationship management, allowing accountants to understand client needs better and proactively address their concerns.

4. Mobile Applications and Client Portals

Mobile applications and client portals offer convenient channels for clients to access financial information, communicate with accountants, and monitor business performance on the go. These technologies promote transparency, foster efficient communication, and empower clients to stay informed and engaged with their accounting processes.

5. Robotic Process Automation (RPA)

RPA automates repetitive and rule-based accounting tasks, freeing up valuable time for accountants to focus on higher-value activities. By adopting RPA, accounting firms can improve accuracy, reduce processing times, and allocate more resources to personalized client services. RPA enhances the client experience by ensuring swift and error-free accounting processes.

Conclusion

Embracing client-centric technologies and strategies is essential for the UK accounting industry to meet evolving client expectations and remain competitive. Investing in client-centric approaches not only enhances service delivery but also positions accounting firms as trusted advisors and valued partners in their clients’ financial journey. The transition to client-centricity is a pathway to success in the dynamic and ever-evolving UK accounting industry.

Challenge #4: Cybersecurity and Data Protection

The Government of the United Kingdom’s Cyber Security Breach survey 2023 reported that 59% medium business reported for data breaches in the last year [10]. As accounting firms increasingly rely on technology and digital processes to deliver services, the risk of cyber threats and data breaches becomes more pronounced. Safeguarding client data and maintaining trust are paramount for accounting firms.

In this chapter, we explore the key sub-challenges that ensue from this emerging challenge and delve into mitigation strategies that the UK accounting industry should adopt to safeguard sensitive information and fortify its defenses against cyber threats.

6 Cybersecurity Challenges that Accounting Outsourcing Firms Tackle and How to Tackle Them

1. Data Breaches and Cyber Attacks

Sub-Challenge: The risk of data breaches and cyber-attacks looms large, posing a significant threat to sensitive financial data and client information. Cybercriminals target accounting firms to gain access to valuable data, causing potential financial loss and reputational damage.Mitigation Strategy: Strengthen cybersecurity measures by investing in robust firewall systems, encryption protocols, and intrusion detection tools. Implement multi-factor authentication and regularly update software to close vulnerabilities. Conduct regular cybersecurity training for staff to raise awareness about phishing attempts and social engineering tactics.

2. Compliance with Data Protection Regulations

Sub-Challenge: Compliance with data protection regulations, such as the General Data Protection Regulation (GDPR), presents a challenge for accounting firms. Failure to comply can result in severe fines and reputational damage.

Mitigation Strategy: Establish a robust data protection framework that adheres to relevant regulations. Implement policies and procedures for handling client data, ensuring transparency about data usage and obtaining explicit consent when necessary. Regularly audit data handling practices to ensure compliance and appoint a Data Protection Officer (DPO) to oversee data protection efforts.

3. Cloud-Based Security Risks

Sub-Challenge: The adoption of cloud-based accounting solutions introduces new security risks. Cloud data storage and access require stringent security measures to prevent unauthorized access and data leakage.

Mitigation Strategy: Choose reputable and secure cloud service providers with a track record of robust security practices. Encrypt data stored in the cloud and regularly back up critical information. Monitor cloud access and usage to detect and address any suspicious activities promptly.

4. Insider Threats

Sub-Challenge: Insider threats pose a considerable risk to data security. Unauthorized access or data leaks from employees, contractors, or partners can be as damaging as external cyberattacks.

Mitigation Strategy: Implement strict access controls and data segregation to limit employees’ access to sensitive information based on their roles. Conduct regular security awareness training to educate staff about the risks of insider threats and the importance of data protection. Foster a culture of security awareness and encourage employees to report any suspicious activities.

5. Supply Chain Security

Sub-Challenge: Accounting firms often collaborate with third-party vendors and partners, increasing the risk of supply chain attacks. Cybercriminals may target weaker links in the supply chain to gain access to sensitive data.

Mitigation Strategy: Conduct thorough due diligence when selecting vendors and partners, assessing their security practices and track record. Establish clear security protocols and contractual agreements to ensure third-party accountability for data protection. Regularly monitor and audit third-party systems for potential security vulnerabilities.

Conclusion

Cybersecurity and data protection are critical concerns for the UK accounting industry in the face of growing cyber threats and data breaches. Prioritizing cybersecurity and data protection efforts is not only a necessity for regulatory compliance but also a strategic move to protect the reputation and success of accounting firms in an increasingly digital and interconnected world.

4 Ways AI can Unlock Better Data Security for Accounting Firms

5 Reasons to Prioritise Safeguarding Sensitive Financial Information

As cyber threats continue to escalate, safeguarding sensitive financial information becomes a critical imperative. The protection of client data and financial records is not only a legal requirement but also a fundamental element in building and maintaining client confidence.

In this chapter, we explore five compelling reasons why the UK accounting industry must prioritize safeguarding sensitive financial information to effectively tackle cybersecurity challenges and ensure client trust.

1. Preserving Client Confidentiality

Client confidentiality is at the core of the accounting profession. Safeguarding sensitive financial information is essential to uphold the trust clients place in their accountants. By adopting robust cybersecurity measures, accounting firms can protect client data from unauthorized access and ensure the utmost confidentiality in their interactions.

2. Mitigating Cybersecurity Risks

The UK accounting industry is a prime target for cybercriminals due to the valuable financial data it holds. From ransomware attacks to phishing attempts, the risks are diverse and ever-evolving. By proactively implementing cybersecurity protocols and investing in state-of-the-art security technologies, accounting firms can mitigate the risks and fortify their defenses against cyber threats.

3. Compliance with Data Protection Regulations

The General Data Protection Regulation (GDPR) and other data protection regulations impose strict requirements on handling sensitive financial information. Failure to comply can result in severe financial penalties and reputational damage. By prioritizing data protection and adherence to regulatory guidelines, accounting firms can demonstrate their commitment to maintaining the highest ethical standards.

4. Enhancing Client Trust and Loyalty

Safeguarding sensitive financial information fosters an environment of trust and reliability between accounting firms and their clients. Clients seek assurance that their data is safe in the hands of their accountants. By instilling confidence in the security measures in place, accounting firms can enhance client trust and foster long-lasting, loyal relationships.

5. Protecting Business Reputation

A data breach can have far-reaching consequences, including damage to the reputation of the accounting firm. News of a security breach can spread quickly, eroding the trust of existing clients and deterring potential clients. By prioritizing data security and safeguarding sensitive financial information, accounting firms can protect their business reputation and maintain a competitive edge in the market.

Conclusion

The UK accounting industry faces a multitude of cybersecurity challenges that necessitate a proactive and robust approach to safeguarding sensitive financial information. Implementing stringent cybersecurity measures is not only a legal requirement but a strategic decision that enables accounting firms to thrive in an era defined by digital transformation and heightened cyber threats. Upholding the highest standards of data protection establishes accounting firms as trusted partners in their clients’ financial journey and reinforces their position as pillars of trust and security in the ever-evolving UK accounting industry.

5 Robust Cybersecurity Measures to Safeguard Data Integrity

Clients entrust their sensitive financial information to accounting firms, expecting confidentiality and security. To uphold client confidence and ensure the integrity of financial data, accounting firms must implement robust cybersecurity strategies.

In this chapter, we delve into the imperative for the UK accounting industry to prioritize cybersecurity and list key technologies that can aid in this crucial transition, fortifying trust with clients.

The Need for Implementing Robust Cybersecurity Measures

In the digital age, cybersecurity is a fundamental pillar of client confidence in the accounting industry. Cyber threats continue to evolve, with sophisticated attacks targeting sensitive financial data. Accounting firms face the risk of data breaches, ransomware attacks, and phishing attempts that can severely impact client trust and business reputation. Implementing robust cybersecurity measures is not only an ethical responsibility but also a strategic decision to safeguard client confidence and retain a competitive edge.

5 Technologies to Aid in Cybersecurity Implementation

1. Multi-Factor Authentication (MFA)

Multi-factor authentication adds an extra layer of security by requiring users to provide multiple forms of identification before accessing systems or data. Implementing MFA reduces the risk of unauthorized access, protecting client information from potential breaches.

2. Endpoint Security Solutions

Endpoint security solutions protect devices such as laptops, desktops, and mobile phones from malware and other cyber threats. By deploying comprehensive endpoint security software, accounting firms can secure all points of entry into their networks.

3. Encryption Technologies

Encryption scrambles sensitive data, making it unreadable without the proper decryption key. Implementing end-to-end encryption ensures that client data remains protected, both in transit and at rest, minimizing the impact of data breaches.

4. Intrusion Detection and Prevention Systems (IDPS)

IDPS continuously monitor network traffic for signs of suspicious activities and potential cyber threats. By proactively detecting and preventing intrusions, IDPS helps accounting firms respond swiftly to mitigate security risks.

5. Security Awareness Training

Technology alone cannot fully protect against cyber threats. Regular security awareness training for staff ensures that employees are aware of potential risks, phishing attempts, and other social engineering tactics. Educating employees about cybersecurity best practices empowers them to be the first line of defense against cyber threats.

Conclusion

Implementing robust cybersecurity measures is paramount for the UK accounting industry to retain client confidence and uphold the trust placed in accounting firms. The aforementioned technologies play instrumental roles in fortifying trust and ensuring the integrity of financial data. Embracing cybersecurity as a core value not only strengthens client relationships but also positions accounting firms as trusted partners in the ever-evolving digital landscape. As the industry navigates the challenges of the digital era, cybersecurity stands as a steadfast shield, guarding the foundation of trust between accounting firms and their valued clients.

?

Did You Know?

- The UK accounting industry is worth £26 billion to the UK GDP.

- The UK exported £3.1 billion in accounting services in 2021, a 22% increase year-on-year.

- The total number of members of the seven accountancy bodies in the UK and ROI has grown steadily at a compound annual growth rate of 2.1% for the period 2016 to 2020.

Become a Smarter Accountant for Free

Join “The Margin” our Newsletter for Business Tips for Accountancy Firms.

3 Potential Opportunities Presenting a Competitive Leap

In October 2022, UK’s inflation rate peaked at 11.1%, with prices industries across the spectrum witnessing rising costs [11]. While addressing the challenges in the UK accounting industry is undeniably crucial, it is equally important to recognize the vast array of opportunities that lie ahead. Embracing these opportunities can transform challenges into stepping stones for growth and success. As the industry evolves in response to technological advancements and changing client expectations, accounting firms have a unique chance to seize emerging prospects and elevate their services to new heights.

In the next part of this article, we will delve into the key opportunities present in the UK accounting industry, exploring how they can propel the industry forward and enable firms to thrive in the ever-changing landscape. Let us now uncover the promising prospects that await in this exciting journey of discovery and growth.

Opportunity #1: Cost Management and Efficiency

Faced with ever-increasing client demands and a competitive market, accounting firms have the opportunity to optimize their operations, streamline processes, and enhance cost effectiveness. In this chapter, we explore why cost management and efficiency are essential opportunities for the UK accounting industry. Here are key avenues that players in this space can explore to achieve greater cost effectiveness and sustainable growth.

1. Enhanced Process Automation

Implementing process automation is a game-changer in achieving cost management and efficiency in the accounting industry. By leveraging technologies like robotic process automation (RPA) and AI-driven software, firms can streamline repetitive tasks, such as data entry, invoice processing, and payroll calculations. Automation reduces human error, increases productivity, and frees up valuable time for accountants to focus on value-added services.

2. Cloud-Based Accounting Solutions

Cloud-based accounting solutions offer a wealth of benefits in terms of cost management and efficiency. These platforms enable seamless collaboration and data sharing among accountants and clients, eliminating the need for physical paperwork and reducing administrative overheads. Cloud-based systems also come with regular updates and maintenance, saving firms from costly hardware investments and maintenance.

3. Outsourcing Non-Core Functions

Outsourcing non-core functions can be a strategic move for accounting firms seeking cost efficiency. By entrusting tasks like bookkeeping, payroll management, and tax preparation to specialized outsourcing partners, firms can reduce operating costs and better allocate resources to high-value client services. Outsourcing allows firms to tap into specialized expertise while focusing on core competencies.

4. Talent Development and Training

Investing in talent development and training is a long-term avenue for cost management and efficiency. By upskilling staff in emerging technologies and industry best practices, firms can enhance employee productivity and effectiveness. Skilled and well-trained employees are more efficient in delivering services, leading to improved client satisfaction and retention.

5. Client Relationship Management

Effective client relationship management is vital for cost management and efficiency. Strengthening existing client relationships and actively seeking referrals can reduce client acquisition costs. Satisfied clients are more likely to provide repeat business, refer new clients, and contribute positively to the firm’s reputation, resulting in cost-effective growth.

Conclusion

Cost management and efficiency present significant opportunities for the UK accounting industry to optimize operations, drive growth, and deliver enhanced client value. Striking the right balance between cost management and delivering exceptional client services is the key to thriving in a competitive landscape. By seizing these opportunities, the UK accounting industry can position itself as a dynamic and forward-looking force, providing efficient solutions that meet evolving client needs and propelling the industry towards continued success.

4 Cost Management Challenges Accounting Outsourcing Firms Face and How to Tackle them

Addressing Cost pressures in the UK Accounting Industry

The UK accounting industry faces an array of cost pressures that demand strategic management and optimization. Understanding the main areas that consume a major share of costs is vital for accounting firms seeking to enhance cost management and efficiency. By implementing targeted measures to minimize or optimize these costs, firms can achieve sustainable profitability and remain competitive in a dynamic business landscape. In this section, we explore the main areas that contribute significantly to costs in the UK accounting industry and outline strategies to address them effectively.

1. Payroll and Staffing Costs

One of the primary cost components for accounting firms is payroll and staffing. Skilled professionals are essential for delivering high-quality services to clients. To optimize this cost, firms can consider the following strategies:

- Assess staffing requirements: Regularly evaluate workloads and assess the need for additional staff or outsourcing to meet fluctuating demand efficiently.

- Talent development: Invest in continuous training and upskilling to enhance staff productivity and reduce the need for outsourcing specialized tasks.

- Remote work opportunities: Embrace remote work options to reduce overhead expenses, such as office space and utilities, while maintaining productivity.

2. Technology and Software Expenses

The adoption of technology and software solutions is integral to the modern accounting industry. However, these expenses can significantly impact overall costs. To optimize technology costs, firms can explore the following avenues:

- Vendor evaluation: Regularly review software and technology vendors to ensure that the chosen solutions align with business needs and provide cost-effective benefits.

- Cloud-based solutions: Leverage cloud-based accounting software, which often offers scalable pricing models and eliminates the need for costly on-premises infrastructure.

- Automation tools: Invest in process automation and AI-driven tools to streamline workflows, reduce manual interventions, and enhance productivity.

3. Compliance and Regulation

Staying compliant with regulatory requirements is a critical aspect of the accounting industry. Compliance costs can be optimized through the following measures:

- Proactive compliance management: Adopt a proactive approach to compliance management to minimize the risk of penalties and fines, which can arise from non-compliance.

- Efficient documentation: Implement efficient document management systems to organize and maintain compliance-related records, reducing time spent on retrieval and audits.

4. Client Acquisition and Retention Costs

Client acquisition and retention are vital for sustained business growth. However, excessive marketing expenses and efforts to attract new clients can impact costs. To optimize client acquisition and retention costs, firms can consider the following:

- Referral programs: Implement client referral programs to encourage satisfied clients to recommend the firm’s services to others, reducing the need for extensive marketing efforts.

- Client relationship management: Prioritize client relationship management to enhance client satisfaction, increase client loyalty, and reduce client churn rates.

- Physical Office Space and Overhead Costs

Maintaining physical office spaces and associated overhead costs can be substantial for accounting firms. To optimize these expenses, firms can consider the following strategies:

- Remote work policies: Encourage flexible work arrangements, such as remote work or hot-desking, to minimize office space requirements and associated costs.

- Shared resources: Consider sharing office spaces and facilities with other businesses or exploring co-working arrangements to reduce overhead expenses.

Conclusion

Addressing cost pressures in the UK accounting industry necessitates a strategic approach that optimizes major cost components while maintaining high-quality services. Embracing technology, implementing talent development programs, optimizing client relationship management, and adopting flexible work arrangements are vital steps in achieving sustainable cost optimization. As accounting firms navigate the complexities of cost management, they can secure a competitive advantage, enhance client value, and thrive in an ever-evolving UK accounting industry.

5 Ways Technology Can Help Achieve Cost Optimization

By leveraging innovative tools and digital solutions, accounting firms can streamline processes, optimize resource allocation, and deliver high-quality services while minimizing operational costs. In this section, we explore five key ways technology can empower the UK accounting industry to achieve cost effectiveness and remain competitive in a dynamic business environment.

1. Process Automation

Process automation is a game-changer for accounting firms seeking cost effectiveness. By automating repetitive and time-consuming tasks, such as data entry, transaction reconciliations, and invoice processing, firms can significantly reduce manual efforts and human errors. Automation tools, such as Robotic Process Automation (RPA) and workflow management software, streamline workflows, improve accuracy, and free up valuable staff time for more strategic and value-added activities. As a result, firms can enhance productivity, minimize operational costs, and deliver faster, error-free services to clients.

2. Cloud-Based Accounting Solutions

Embracing cloud-based accounting solutions offers numerous benefits in terms of cost effectiveness and efficiency. Cloud-based software allows real-time collaboration among accountants and clients, eliminating the need for physical paperwork and reducing administrative overheads. With cloud solutions, accounting firms can avoid costly hardware investments and maintenance expenses, as cloud service providers handle software updates and data security. Cloud-based solutions also facilitate remote work opportunities, enabling firms to optimize physical office space and reduce associated overhead costs.

3. Data Analytics and Business Intelligence

Data analytics and business intelligence technologies empower accounting firms to make data-driven decisions that enhance cost effectiveness. By analyzing key performance indicators, client profitability, and operational expenses, firms can identify areas where improvements can be made. Data analytics tools enable firms to track and manage project costs, optimize resource allocation, and identify cost-saving opportunities. By leveraging data insights, accounting firms can make informed decisions that lead to improved efficiency and enhanced client value.

4. Client Relationship Management (CRM) Systems

CRM systems play a vital role in achieving cost effectiveness by enhancing client relationships and retention. CRM platforms centralize client information, interactions, and preferences, enabling accounting firms to provide personalized services and targeted communication. By understanding client needs and expectations, firms can tailor their services effectively, increasing client satisfaction and loyalty. Satisfied clients are more likely to provide repeat business and referrals, reducing the need for extensive marketing efforts and client acquisition costs.

5. Remote Collaboration and Communication Tools

Online collaboration and communication tools facilitate efficient client interactions and reduce operational costs. Video conferencing, messaging apps, and document-sharing platforms enable seamless communication between accountants and clients, regardless of geographical locations. By reducing the need for in-person meetings and physical document exchanges, these tools save time and expenses related to travel and courier services. Online collaboration tools also enhance team communication and coordination, leading to improved project management and streamlined workflows.

Conclusion

Technology stands as a powerful ally in the quest for cost effectiveness in the UK accounting industry. It empowers accounting firms to streamline workflows, reduce manual efforts, and make data-driven decisions that lead to improved efficiency and cost savings. As the industry continues to evolve, harnessing the potential of technology becomes an indispensable strategic move to remain competitive, deliver high-quality services, and achieve cost effectiveness in the dynamic UK accounting landscape.

Opportunity #2: Future Business Models and Revenue Streams

Stats show that UK’s financial advisory services market grew at a YoY rate of 3.5% from 2017 to 2022, a sign showing players are fast exploring other revenue channels going beyond traditional accounting services [12]. The traditional role of accountants is evolving, driven by technological advancements, changing client expectations, and the need for greater efficiency. To remain relevant and thrive in this transformative landscape, accounting firms have a unique opportunity to explore innovative business models and revenue streams.

In this chapter, we explore why this shift is a key opportunity for the UK accounting industry and outline avenues that players can explore to achieve a future-proof business strategy.

1. Advisory and Consultancy Services

The opportunity lies in transitioning from a transactional approach to a more advisory and consultancy-based model. By providing strategic insights, financial planning, and data-driven advice, accounting firms can become valued partners in their clients’ business growth. Offering personalized solutions and forward-thinking advice positions firms as trusted advisors, enhancing client relationships and opening new revenue streams.

2. Technology Integration and Value-Added Services

Integrating technology into service offerings is a critical avenue for future business models. Leveraging data analytics, AI-driven tools, and cloud-based solutions, accounting firms can deliver value-added services that go beyond compliance-focused tasks. By embracing technology and providing cutting-edge services, firms can attract tech-savvy clients and diversify revenue streams.

3. Specialized Industry Niche Services

Focusing on specialized industry niches presents an opportunity for accounting firms to carve out a unique identity and excel in targeted areas. By developing expertise in niche sectors such as healthcare, fintech, or e-commerce, firms can attract clients seeking tailored solutions and charge premium fees for specialized services.

4. Subscription-Based Models

Embracing subscription-based models can provide a stable and predictable revenue stream for accounting firms. By offering tiered service packages that cater to various client needs, firms can create a recurring revenue model and build long-term client relationships.

5. Ecosystem Partnerships

Collaborating with other service providers, such as legal firms, technology companies, or financial advisors, can expand revenue streams and offer clients comprehensive solutions. Ecosystem partnerships enable firms to access new markets, share resources, and create mutually beneficial alliances.

6. Value-Based Pricing

Shifting from traditional hourly billing to value-based pricing is a transformative step for future business models. By aligning fees with the value delivered to clients, accounting firms can enhance client satisfaction, increase profitability, and create a transparent and trusting relationship with clients.

Conclusion

The UK accounting industry is at a crossroads, and the embrace of future business models and revenue streams presents an exciting opportunity for firms to thrive in a rapidly changing environment. The key lies in embracing change, adopting a forward-thinking mindset, and continuously seeking ways to evolve and add value to clients. As the industry redefines its role and purpose, seizing this opportunity is the path to success in the dynamic UK accounting landscape.

5 Evolving Accounting Business Models to Gauge

In the dynamic and transformative landscape of the UK accounting industry, traditional business models are giving way to innovative approaches that cater to changing client demands and technological advancements. Embracing evolving accounting business models is essential for firms seeking to remain competitive, create new revenue streams, and adapt to the evolving needs of clients. In this section, we explore five key evolving accounting business models that the UK accounting industry should consider to thrive in the future.

1. Virtual Accounting Firms

Virtual accounting firms are emerging as a progressive business model that leverages technology to operate remotely and efficiently. By adopting cloud-based accounting solutions, video conferencing, and digital document management, virtual firms can service clients from anywhere, offering flexible and cost-effective solutions. This model allows firms to access a broader client base and reduce overhead expenses associated with physical offices, while still delivering high-quality services.

2. Niche Focused Firms

Niche focused firms concentrate their services on specific industries or client segments, tailoring their expertise to meet unique requirements. By developing in-depth knowledge and specialization in areas such as technology startups, healthcare, or renewable energy, niche focused firms attract clients seeking customized solutions. This approach not only enables firms to charge premium fees for specialized services but also fosters stronger client loyalty and word-of-mouth referrals within the targeted niche.

3. Hybrid Service Providers

Hybrid service providers combine traditional accounting services with value-added consulting and advisory services. This business model emphasizes data analysis, financial forecasting, and strategic planning, positioning the firm as a trusted advisor to clients’ business growth. By offering a holistic suite of services, hybrid providers build deeper client relationships and generate additional revenue through advisory fees.

4. Collaborative Ecosystem Firms

Collaborative ecosystem firms form partnerships with complementary service providers, such as legal firms, technology companies, or financial advisors. By collaborating with these partners, accounting firms can offer clients comprehensive solutions that address multiple aspects of their business needs. Ecosystem partnerships facilitate cross-referrals and access to a broader client base, while also expanding revenue streams through shared resources and expertise.

5. Subscription-Based Firms

Subscription-based business models are gaining traction in the accounting industry, where firms offer clients tiered service packages on a subscription basis. Clients can choose from various levels of service, each with a corresponding fee structure. This model provides a stable and predictable revenue stream for firms while ensuring clients receive consistent support and guidance.

Conclusion

As the UK accounting industry evolves, embracing new and evolving business models becomes essential for firms seeking to stay ahead of the curve. By adapting to these emerging business models, accounting firms can attract diverse clientele, create new revenue streams, and deliver value-added services that meet the changing needs of clients. The key lies in adopting a forward-thinking mindset, embracing technology, and continuously exploring new opportunities for growth and innovation. As the industry redefines its role and purpose, embracing these evolving business models is the path to success and prosperity in the ever-changing UK accounting landscape.

5 Emerging Business Models in the Accounting Outsourcing Industry

5 Reasons for UK Accounting firms to Adapt to Advisory and Consultancy Roles

Traditional compliance-focused services are no longer sufficient to meet the complex needs of clients in the digital age. Embracing advisory and consultancy roles allows accounting firms to become strategic partners to their clients’ businesses, offering valuable insights, data-driven advice, and forward-thinking solutions.

In this section, we explore five compelling reasons why the UK accounting industry should make this pivotal shift towards advisory and consultancy roles.

1. Adding Higher Value to Clients

By shifting towards advisory and consultancy roles, accounting firms can deliver higher value to clients. Instead of solely focusing on compliance and basic bookkeeping tasks, firms can offer strategic financial planning, data analysis, and financial forecasting. These value-added services provide clients with crucial insights to make informed business decisions and drive growth. The increased value strengthens client relationships, fosters loyalty, and positions accounting firms as indispensable partners in their clients’ success.

2. Embracing the Technological Shift

As technology rapidly transforms the accounting landscape, automation and digitization are reshaping traditional accounting processes. Embracing advisory and consultancy roles enables firms to leverage technology effectively. By integrating data analytics, AI-driven tools, and cloud-based solutions into their services, accounting firms can deliver more sophisticated and data-driven advice, staying ahead of the technological curve and meeting clients’ expectations.

3. Differentiating in a Competitive Market

The accounting industry is becoming increasingly competitive, with traditional services becoming commoditized. Shifting towards advisory and consultancy roles allows firms to differentiate themselves in the market. Firms that can offer strategic advice, personalized solutions, and deep industry expertise stand out from competitors, attracting more discerning clients seeking specialized support.

4. Capitalizing on Client Demand

Modern clients expect more than just standard accounting services. They seek proactive guidance, financial insights, and assistance in navigating complex financial challenges. Shifting towards advisory and consultancy roles addresses this demand, meeting clients’ evolving needs and positioning firms as trusted advisors in a rapidly changing business landscape.

5. Diversifying Revenue Streams

Advisory and consultancy services open new revenue streams for accounting firms. While traditional services may have a predictable billing cycle, advisory services can be offered on a project basis or as ongoing retainer agreements. This diversification of revenue streams provides stability and increases profitability for firms, reducing reliance on compliance-driven revenue alone.

Conclusion

Shifting towards advisory and consultancy roles is a transformational step for the UK accounting industry. Embracing advisory roles allows firms to be proactive partners to their clients, offering strategic guidance and data-driven insights that drive business success. As the accounting landscape continues to evolve, making this pivotal shift is essential for firms seeking sustained growth, relevance, and success in the dynamic UK accounting industry.

3 Reasons to Diversify Revenue Streams and Embrace Innovation

Diversifying revenue streams and embracing innovation are crucial strategies for long-term growth and success. By exploring new revenue streams and embracing innovative practices, accounting firms can secure their position as agile and forward-thinking partners to their clients.

In this section, we explore five compelling reasons why the UK accounting industry should diversify revenue streams and embrace innovation.

1. Reducing Dependence on Traditional Services

Relying solely on traditional accounting services exposes firms to market fluctuations and increasing competition. Diversifying revenue streams enables firms to reduce their dependence on compliance-driven services and explore new opportunities for growth. By expanding service offerings to include advisory, consulting, technology integration, and specialized niche services, accounting firms can mitigate risks and achieve a more balanced revenue portfolio.

2. Unlocking New Growth Opportunities

Diversifying revenue streams opens doors to new growth opportunities for accounting firms. Expanding into emerging industries, offering specialized services, and forming strategic partnerships with complementary businesses can unlock untapped markets and attract diverse clientele. Embracing innovation allows firms to remain agile in identifying and capitalizing on new growth prospects.